Piercing Line Candlesticks and Dark Cloud Cover candlesticks

Bullish Stock Candlestick Patterns Tutorial and Bearish Stock Candlestick Patterns Guide

A Piercing Line Stock Candle Pattern & Dark Cloud Cover Candle Pattern look alike but the difference is that one occurs at the top of a Stock Indices up trend (Cloud Cover) and the other occurs at the bottom of a downwards trend (Piercing).

Upward Stock Indices Trend Reversal - Dark Cloud Cover Candlesticks

Downward Stock Indices Trend Reversal - Piercing Line Candles

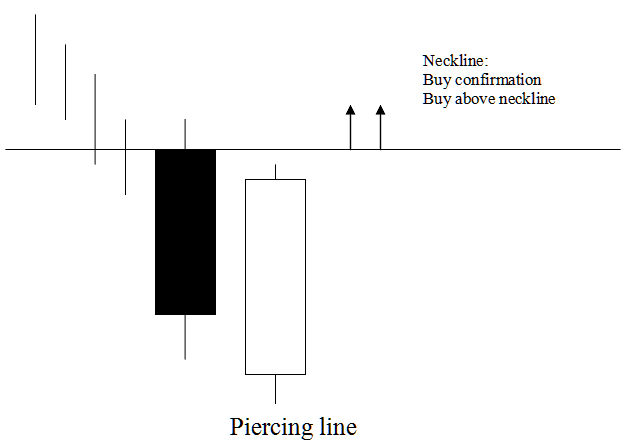

Piercing Line Candlestick

Piercing line is a long black body followed by a long white body candle.

White body pierces the midpoint of the prior black body.

This is a bullish reversal pattern that occurs at the bottom of a market downwards trend. It shows that the market opens lower & closes above the midpoint of the black body.

This displays that the momentum of the down trend is reducing & market trend is likely to reverse & move in an up-wards direction.

This pattern is displayed known as a piercing line signifying the market is piercing the bottom showing a market floor for the price downwards trading trend.

Piercing Line Candlestick

Technical Analysis Piercing Line Candle

A buy signal is confirmed once price closes above the neckline this is the opening of the candlestick on the left of the Piercing Line candle.

This is a bullish setup and price should continue moving up-wards & for one who puts a buy trade should also place a stop loss order just below the lowest price level.

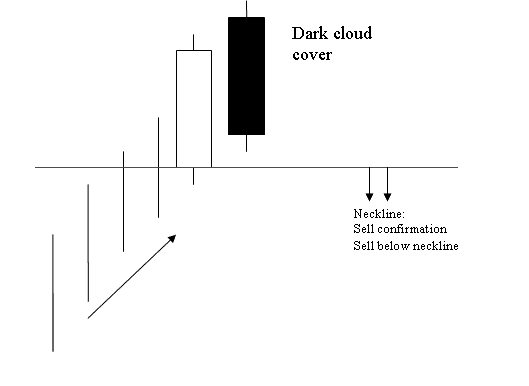

Dark Cloud Cover Candlestick

Opposite of piercing candlestick.

This candle is a long white body followed by a long black body.

The black body pierces the mid point of the prior white body.

This is a bearish reversal pattern which forms at the tops of an up-ward trend.

It shows that the market opens higher & closes below the midpoint of the white body.

This displays that the momentum of the up trend is reducing & market trend is likely to reverse & move in a downward direction.

This pattern is shown known as a cloud cover signifying the cloud as a ceiling for the price up-ward trend.

Dark Cloud Cover Candle

Technical Analysis Dark Cloud Cover Candle

A sell signal is confirmed once price closes below the neck-line which is the opening of the candlestick on the left of this candle.

This is a bearish setup and price should continue moving down-wards & for one who puts a sell trade should also put a stoploss order just above the highest price level.