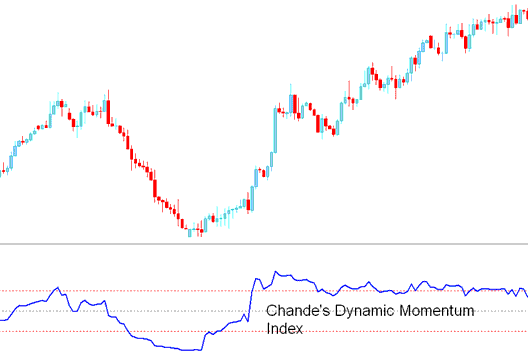

Chandes Dynamic Momentum Technical Analysis & Chande DMI Signals

Developed by Tushar Chandes

Chande DMI indicator is similar to Welles Wilder’s Relative Strength indicator, however, there's one very important difference.

RSI uses a fixed number of stock price periods while the Chande Momentum Dynamic Index uses a variable amount of stock price periods as market volatility changes.

The number of stock price periods used by this Momentum indicator decreases as market volatility increases. This allows the technical indicator to be more responsive to price changes.

The Chande DMI is more accurate than the RSI, has less whipsaws & is less Choppy

Technical Analysis & How to Generate Signals

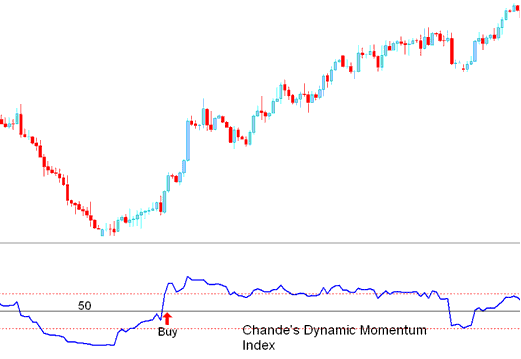

Buy Signal

A buy signal is generated when DMI crosses above 50 level mark.

Buy Signal

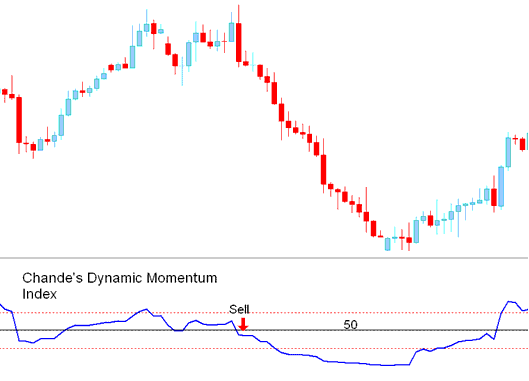

Sell Signal

A sell signal is generated when DMI crosses below 50 level mark.

Sell Signal