Stock Divergence Indices SETUPS SUMMARY

Classic Bearish - HH stock price, LH indicator - Indicates the underlying weakness of a trend - Warning of a possible change in the trend from up to down.

Classic Bullish - LL stock price, HL indicator - Indicates the underlying weakness of a trend - Warning of a possible change in the trend from down to up.

Hidden Bearish - LH stock price, HH indicator - Indicates the underlying strength of a trend - Mainly found during corrective rallies in a down-wards trend.

Hidden Bullish - HL stock price, LL indicator - Indicates the underlying strength of a trend - Occurs mainly during corrective declines in an upward trend.

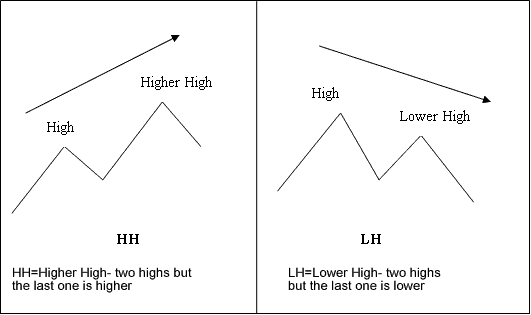

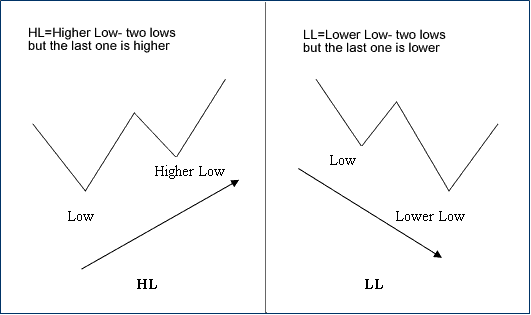

Illustrations of the divergence terms:

M-shapes dealing with price highs

M-shapes

W-shapes dealing with price lows

W-shapes

These are shapes to look for when using these setups.

One of the best indicator for this setup is the MACD Technical Indicator - as a trading signal MACD divergence is a setup to enter a trade. But as with any signal there are certain precautions which have to be observed to make this signal a set-up. Getting straight in to a trade as soon as you see this setup isn't the best strategy. This setup should be used in combination with another indicator to confirm the direction of the trend. A good system to combine with is the moving average crossover system.

Be aware this setup on a smaller time frame isn't so significant. When divergence is seen on a 15 minute chart it may or may not be very important as compared to the 4 hour chart time frame on MT4 platform.

If seen on a 60 minute chart, 4 hour chart, or daily chart time frame, then start looking for other factors to indicate when the price may react to the divergence.

This brings us to a key point when using this signal to enter a trade: on a higher time frame MACD divergence can be a fairly reliable indicator of a change in price direction. However, the big question is: WHEN? That is why getting straight in to a trade as soon as you see this setup isn't always the best strategy.

Many investors get caught out by entering the market too soon when they see MACD divergence. In many cases, stock price has still got some momentum to continue in the current direction. The investor who has jumped in too soon can only stare at the screen in dismay as price shoots through his stoploss taking him out.

If you simply look for this setup without any other considerations you will not be aligning yourself with the best odds, so to increase the odds of making a successful trade you should also look at other factors, specifically other indicators.

What other factors should you consider when using this setup?

1. Support level, Resistance levels and Indices Fibo levels on higher Chart Timeframes

Another way to greatly increase the odds of a winning trade is to observe higher chart timeframes before opening an order based on lower timeframes.

If you observe that the hourly, 4 hour or daily chart has met a major resistance, support or Fibonacci level then probability of a successful trade based on divergence on a lower timeframe at this point increases.

2. Reward to Risk Ratio: Stock Money Management Principles

And finally, when looking for divergence, it's very important that you enter the trade correctly, so that you have a good risk/reward ratio & only open transactions thatwhich have more profit potential than what you're risking. If you understand how to enter a transaction properly, you can measure your risk/reward before you open a transaction. That way, you can only select to open orders that offer a favorable ratio.

Finally, when used correctly and combined with other indicators to confirm this trading signal, divergence set-up can offer huge profit potential.