Coppock Curve Stock Analysis & Coppock Curve Signals

Developed by Edwin Sedgwick Coppock

This technical indicator was used for analysis of Stocks & Commodities in the beginning but was later used to trade Stock Indices.

The principle behind this is the psychology of trading, based on the theory that human habit is predictable. And price movement always oscillates in a zigzag manner.

The principle of adaptation-level applies to how stock price reacts at certain levels, stock and prices will react in the same way or pattern as those observed historically.

Stock Analysis & How to Generate Signals

In stock index trading, The moving average is the simplest form of an adaptation-level, the price will oscillate around the moving average. This forms the basis of this indicator, which is a longer term oscillator based on this adaptation-levels(moving average), but in a different way.

Oscillators usually begin by calculating a % change of the current price from some previous price point, where the previous price point is the reference point (adaptation-level).

Edwin Coppock reasoned that the market participants' emotional state could be quantified by summing up the % changes over the recent past to get a general sense of the market's longer term momentum.

For example, If we compare prices relative to a year ago and we see that this month the market is up 20% compared to a year ago, last month it was up 15% over a year ago, & 10 %, 7.50% & 5% respectively the months before that, then we may ascertain that the market is gaining momentum.

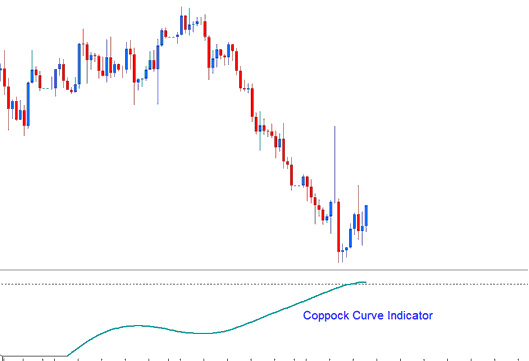

Basic signals can also be generated using the Coppock Curve to trade market reversals from extreme price levels. Looking for divergence and trend line breaks may also be combined to confirm the signal.

Implementation

The input levels of this indicator might need to be adjusted to better fit the dynamic nature of the markets trading.

Coppock Curve has a zero line reference point, but this doesn't represent the adaptation-level but it's only a visual reference point only.