What is True Strength Index TSI Indicator? - Definition of TSI Indicator

True Strength Index TSI indicator - True Strength Index TSI technical indicators is a popular indicator that can be found on the - Indicators List on this website. True Strength Index TSI indicator is used by traders to forecast price movement depending on the chart price analysis done using this True Strength Index TSI indicator. Traders can use the True Strength Index TSI buy and Sell Signals explained below to determine when to open a buy or sell trade when using this True Strength Index TSI indicator. By using True Strength Index TSI and other indicators combinations traders can learn how to make decisions about market entry and market exit.

What's True Strength Index TSI Indicator? True Strength Index TSI Indicator

How Do You Combine Indicators with True Strength Index TSI? - Adding TSI Indicator in MT4

Which Indicator is the Best to Combine with True Strength Index TSI?

Which is the best True Strength Index TSI trading indicator combination for trading?

The most popular indicators combined with True Strength Index TSI are:

- RSI

- MAs Indicator

- MACD

- Bollinger ##BandsBand

- Stochastic

- Ichimoku Kinko Hyo Indicator

- Parabolic SAR

Which is the best True Strength Index TSI indicator combination for trading? - True Strength Index TSI MT4 indicators

What Indicators to Combine with True Strength Index TSI?

Find additional indicators in addition to True Strength Index TSI indicator which will determine the trend of the market as well as others that confirm the market trend. By combining indicators that determine trend & others that confirm the trend & combining these indicators with True Strength Index TSI indicator a trader will come up with a True Strength Index TSI based trading system that they can test using a practice trading demo account on the MetaTrader 4 platform.

This True Strength Index TSI based trading system will also help traders to determine when there is a market reversal based on the indicators signals generated and therefore trades can know when to exit the market if they have open trade transactions.

What is True Strength Index TSI Indicator Based Trading? Indicator based system to interpret price & provide trading signals.

What is the Best True Strength Index TSI Strategy?

How to Choose the Best True Strength Index TSI Strategy

For traders researching on What is the best True Strength Index TSI strategy - the following learn trading tutorials will help traders on the steps required to tutorial them with coming up with the best strategy for trading market based on the True Strength Index TSI indicator trading system.

How to Create True Strength Index TSI Strategies

- What is True Strength Index TSI Indicator System

- Creating True Strength Index TSI System Template

- Writing True Strength Index TSI System Rules

- Generating True Strength Index TSI Buy and True Strength Index TSI Sell Signals

- Creating True Strength Index TSI Indicator Trading System Tips

About True Strength Index TSI Indicator Explained

True Strength Index (TSI) Analysis & TSI Signals

Developed by William Blau

TSI is a momentum indicator. The TSI is plotted by using a momentum calculation that reacts faster and is more responsive to price changes, making it a leading indicator that follows price action direction closely in the trading market.

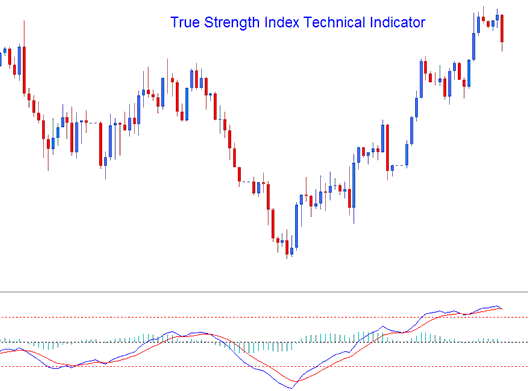

The True Strength Index is plotted as a blue line, the indicator also plots a signal line which is plotted as a red line, and these two lines are used to generate crossover signals.

True Strength Index also plots a histogram which shows the difference between the TSI Line & the Signal line. This histogram crosses above or below the center lines, histogram levels above the center line shows a bullish crossover signal, while center line levels below the center line shows a bearish crossover signal.

FX Analysis and How to Generate Signals

The TSI uses various methods to generate trading signals. This indicator can be used in the same way as the RSI to determine general trend direction of currency markets. Overbought and oversold levels also can be shown using TSI. The most common methods of generating trade signals are:

Zero line Cross over (Histogram Forex cross-over not Lines Trading cross-over )

- Buy - when the histogram crosses above 0 a buy gets generated

- Sell - when the histogram crosses below 0 a sell is generated

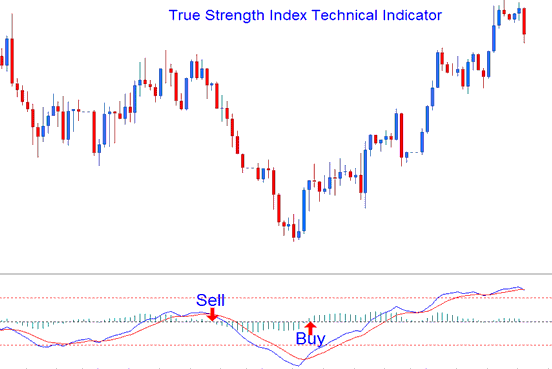

Signal line Trading Crossover

- A buy gets generated when TSI line crosses above Signal Line

- A sell is generated when TSI line crosses below Signal Line

This signal is the same as the one above & the timing corresponds to the time when the histogram crossover happen.

Divergence Trading

Divergence is used to look for potential trend reversal point of a forex pair. The reversal divergence setups are:

Classic FX Divergence

Classic Bullish Divergence: Lower lows in price & higher lows on the indicator

Classic Bearish Divergence: Higher highs in price and lower highs on the indicator

Divergence trading also can be used in identifying potential trend continuation points in price action direction. The continuation divergence trading setups are:

Hidden Trading Divergence Setup

Hidden Bullish Divergence: higher lows in price & lower lows on the indicator

Hidden Bearish Divergence: lower highs in price and higher highs on the indicator

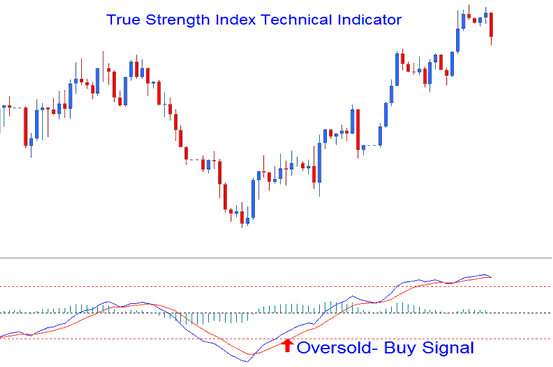

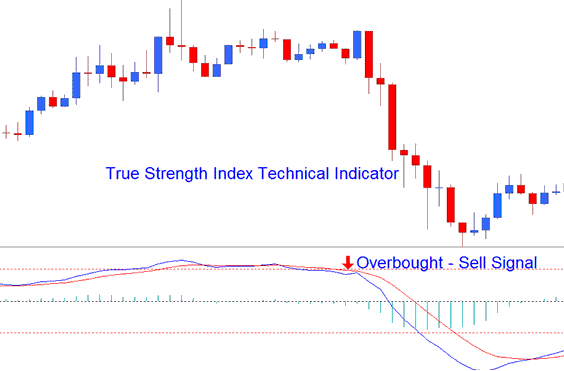

Overbought/Oversold Levels on Indicator

This can be used to identify overbought and oversold conditions in price action movements.

- Overbought condition - levels being greater than the +25 level

- Oversold condition - levels being less than the -25 level

Trades can be generated when TSI crosses these levels.

Buy signal - when the levels cross above -25 level a buy gets generated.

Sell signal - when the levels cross below +25 level a sell is generated.

Oversold - Buy Signal

Overbought - Sell Signal

The overbought/oversold levels are indicated using horizontal lines plotted at the +25 and -25 levels.