What's McClellan Histogram Indicator? - Definition of McClellan Histogram Indicator

McClellan Histogram - McClellan Histogram indicators is a popular technical indicator which can be found in the - Indicators Listing on this website. McClellan Histogram is used by the FX traders to forecast price movement based on the chart price analysis done using this McClellan Histogram indicator. Traders can use the McClellan Histogram buy & Sell Trading Signals explained below to figure out when to open a buy or sell trade when using this McClellan Histogram indicator. By using McClellan Histogram and other indicators combinations traders can learn how to make decisions about market entry and market exit.

What's McClellan Histogram Indicator? McClellan Histogram Indicator

How Do You Combine Indicators with McClellan Histogram? - Adding McClellan Histogram on MT4 Platform

Which Indicator is the Best to Combine with McClellan Histogram?

Which is the best McClellan Histogram combination for forex trading?

Most popular indicators combined with McClellan Histogram are:

- Relative Strength Index

- MAs Moving Averages Forex Indicator

- MACD

- Bollinger Bands Indicator

- Stochastic Technical Indicator

- Ichimoku Indicator

- Parabolic SAR

Which is the best McClellan Histogram combination for Forex trading? - McClellan Histogram MT4 indicators

What Indicators to Combine with McClellan Histogram?

Get additional indicators in addition to McClellan Histogram that will determine the trend of the price and also others that confirm the market trend. By combining indicators which determine trend and others that confirm the trend and combining these technical indicators with FX McClellan Histogram a trader will come up with a McClellan Histogram based system that they can test using a demo account on the MT4 software.

This McClellan Histogram based system will also help traders to figure out when there is a market reversal based on the technical indicators signals generated and thence trades can know when to exit the market if they have open trades.

What is McClellan Histogram Based Trading? Indicator based system to analyze and interpret price & provide trade signals.

What's the Best McClellan Histogram Strategy?

How to Select and Choose the Best McClellan Histogram Strategy

For traders researching on What is the best McClellan Histogram strategy - the following learn forex tutorials will help traders on the steps required to guide them with coming up with the best strategy for market based on the McClellan Histogram system.

How to Make McClellan Histogram Systems

- What is McClellan Histogram Strategy

- Creating McClellan Histogram Strategy Template

- Writing McClellan Histogram Strategy Trading Rules

- Generating McClellan Histogram Buy and McClellan Histogram Sell Trading Signals

- Creating McClellan Histogram Trading System Tips

About McClellan Histogram Described

McClellan Histogram Analysis and McClellan Histogram Signals

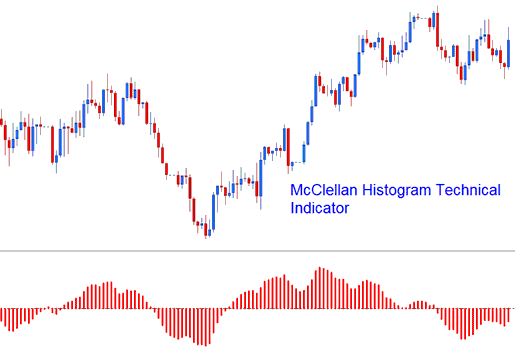

The McClellan Histogram is a graphical representation of the McClellan Oscillator and its signal line. This difference between the two is plotted as a histogram.

This is an oscillator trading indicator, the center line is the zero cross over mark which is used to generate buy and sell signals.

McClellan Histogram

FX Analysis and Generating Signals

The Histogram is momentum indicator. Signals are derived and generated using the centerline cross over trading method.

- Bullish trading signal - Above Zero

- Bearish Signal - Below Zero

There are 2 fundamental techniques for using this technical indicator to generate trade signals.

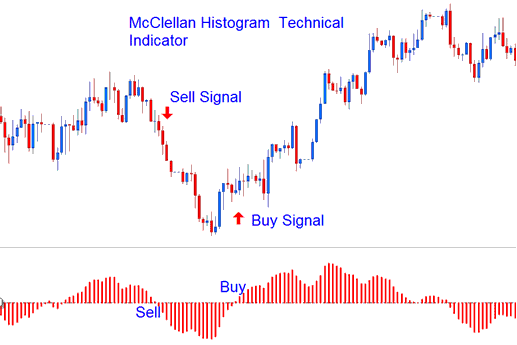

Zero-Level Cross-over - When the histogram crosses above zero a buy signal is generated. Otherwise, when the histogram oscillator technical indicator crosses below zero mark a sell trading signal is generated.

Analysis in FX Trading

Divergence Trading - divergence between this trading indicator and the chart can prove to be an effective Forex strategy in spotting potential price trend reversal signals and trend continuation trade signals.

There are various types of Divergence:

Trend Reversal Signals - Classic Divergence Trading Setup Signals

- Classic Bullish Divergence Trading Setup Signals - Lower lows on price chart and higher lows on the McClellan Histogram

- Classic Bearish Divergence Trade Setup Signals - Higher highs on price chart & lower highs on the McClellan Histogram

Trend Continuation Signals - Hidden Divergence Trading Setup Signal

- Hidden Bullish Divergence Trade Setup Signals- Lower lows in McClellan Histogram and higher lows on the price chart

- Hidden Bearish Divergence Trade Setup Signals- Higher highs in McClellan Histogram and lower highs on the price chart

To Learn more about divergence navigate to divergence topic on this site

Learn More Courses and Courses:

- What is GER30 in Forex Trading?

- Index Trading Strategy for Trading SWI20 Indices

- MetaTrader 4 Grid, Volumes, Auto Scroll & Chart Shift on MT4 Software Platform

- Symbol Nasdaq on MT4 Software

- EURDKK System EURDKK Trade Strategy

- How Do I Trade & Develop a MT5 Gold Automated Expert Advisor(EA) in MT5 Platform?

- List of XAUUSD Learning Basics Course Tutorials for Gold Traders

- How Can I Use MetaTrader 4 Alligator Indicator?

- How to Add Forex Channel Technical Indicator in MT4 Charts

- Forex Courses for Trading Forex Beginner Traders