What's Linear Regression Technical Indicator? - Meaning of Linear Regression Indicator

Linear Regression - Linear Regression indicators is a popular indicator which can be found in the - Indicators List on this site. Linear Regression is used by the traders to fore-cast price movement depending on the chart price analysis done using this Linear Regression indicator. Traders can use the Linear Regression buy & Sell Trading Signals described below to identify when to open a buy or sell trade when using this Linear Regression indicator. By using Linear Regression and other indicators combinations traders can learn how to make decisions about market entry and market exit.

What's Linear Regression Indicator? Linear Regression Indicator

How Do You Combine Indicators with Linear Regression? - Adding Linear Regression in the MT4 Software

Which Indicator is the Best to Combine with Linear Regression?

Which is the best Linear Regression combination for trading?

The most popular indicators combined with Linear Regression are:

- Relative Strength Index

- MAs Moving Averages Indicator

- MACD

- Bollinger Bands Indicator

- Stochastic

- Ichimoku Indicator

- Parabolic SAR

Which is the best Linear Regression combination for trading? - Linear Regression MT4 indicators

What Indicators to Combine with Linear Regression?

Get additional indicators in addition to Linear Regression that will determine the trend of the market price & also others that confirm the market trend. By combining indicators that determine trend & others that confirm the trend & combining these indicators with Linear Regression a trader will come up with a Linear Regression based system that they can test using a demo account on the MetaTrader 4 platform.

This Linear Regression based strategy will also help traders to identify when there is a market reversal based on the technical indicators signals generated and thence trades can know when to exit the market if they have open trades.

What is Linear Regression Technical Indicator Based Trading? Technical Indicator based strategy to analyze and interpret price and provide signals.

What's the Best Linear Regression Trading Strategy?

How to Choose & Select the Best Linear Regression Strategy

For traders researching on What's the best Linear Regression strategy - the following learn tutorials will help traders on the steps required to course them with creating the best trading strategy for market based on the Linear Regression system.

How to Make Linear Regression Trading Strategies

- What's Linear Regression System

- Making Linear Regression System Template

- Writing Linear Regression System Rules

- Generating Linear Regression Buy and Linear Regression Sell Trading Signals

- Making Linear Regression Technical Indicator Trading System Tips

About Linear Regression Described

Linear Regression Analysis and Linear Regression Signals

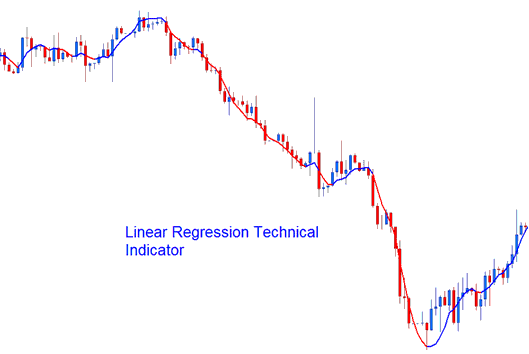

Another name for a regression line is a line of best fit/best fit line. This technical indicator draws the market trend of the currency price over a specified duration of time. The market trend is determined by calculating a Linear Regression Trendline using the "least square fit" method. This technique helps to minimize distance between the price data points and the line of best fit.

Unlike the straight Regression Trendline indicator, the technical indicator draws end values of multiple Linear Regression trend lines. Any single point along the Linear Regression will be equivalent to the end value of a Regression Trendline, but the resulting trend line looks like the MA Moving Average.

But unlike the MA, this indicator does not show as much delay since it's fitting a line on to info points rather than averaging them.

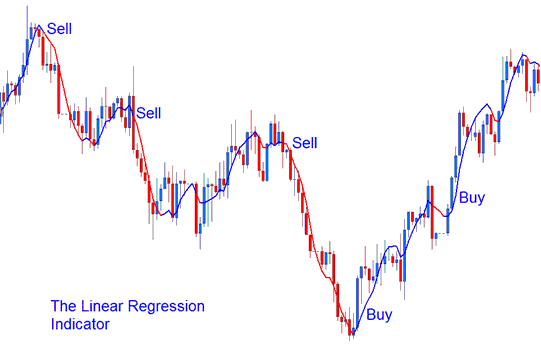

The Linear Regression is a prediction of the tomorrow's price drawn today, one day before. When the market prices are steadily higher or steadily lower than the forecast price, then a forex trader can expect them to return quickly to more realistic fore-casted levels.

In other terms, this technical indicator shows where the chart prices "should" be trading based on a statistical basis and any dis-proportionate deviation from the regression line is likely to be short lived.

Forex Analysis and Generating Signals

This indicator allows for the price choice, adjusting number of periods and smoothing out of price info before applying the calculation and the choice of smoothing type.

This indicator looks like a MA(Moving Average) but it has a bi-colour representation.

- Bullish Signal (Blue colour) - A rising line (higher than its previous value one previous bar before) is displayed and illustrated in the uptrend blue colour, while

- Bearish Signal (Red colour) - a falling line (lower and lesser than its previous value one previous bar before) is illustrated & displayed in the downtrend red colour.

Analysis in FX Trading

Learn More Topics and Tutorials:

- IT 40 Indices Methods List & Best IT40 Index Strategies for IT40

- Bollinger Band MT4 Trading Indicator

- How to Interpret/Analyze and Analyze FX Base Currency Exchange Rate Quotes

- Choppiness Index Gold Indicator Analysis in XAU USD Charts

- Bulls Power MetaTrader 4 Trading Indicator Example Explained

- How Can I Use Choppiness Index in Forex Trading?

- How Can I Add IT40 in MT5 Mobile App?

- SMI XAU/USD Indicator Technical Analysis

- Ultimate MetaTrader 4 Indicator in Forex Trading

- What Does 20% XAU/USD Margin Requirement Mean in XAU USD?