What's Trade? - Where to Trade Forex - How to Start Trade

Many traders are beginning to ask around about what's Trade? - What's Trade? - What is Trade? - Where to Trade Forex - How to Trade FX? and How to Start Trade? - the most common questions that most new traders ask are:

- What's Trade? - Where to Trade Forex?

- What is a Platform?

- How to Start Trade?

- What is a Trading System?

Most of these questions are discussed in other topics, but the basic question is What's Forex??

The forex is an international online trading market where $7.2 trillion dollars is transacted everyday.

The trade market was established in 1971, when the floating exchange rate system was introduced. The trade market is not centralized, unlike the stocks.

Trade is done through interbank connections through banks which are known as forex liquidity providers & forex brokers that connect individual traders to this interbank network. therefore occurs over computer and telephone networks at thousands of locations worldwide.

This makes the trade market is a decentralized market formed by a large network of banks collectively known as the interbank market. These are the banks that determine the exchange rates based on the supply and demand for these currencies.

The trade market is commonly referred to as FOREX, Forex or Spot Forex and this is where banks, corporations, investors and retail traders exchange one currency for another either for the purpose of carrying out international trade or for profiting from the exchange rates difference.

The currencies transacted are named using 3 alphabetic symbols, the first 2 represent the name of the specific country while the third symbol represents the first initial/letter of that given currency.

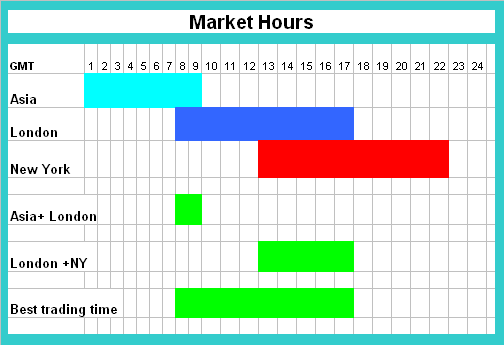

The trade market is the largest financial market in the world and 7.2 trillion dollars is traded every day, compared & analyzed to USA stocks which trade 0.5 trillion dollars. FX is opened 24 hrs a day because it's an interbank market whereby if banking centers in the USA are closed those in Europe are open, and when these are not opened those in Asia are opened. The typical Trade day starts in Sydney, then Tokyo, then London and finishes with the New York market session.

In the market 90% of all trades is done for the purpose of speculation for profit, the rest is traded for the purpose of settling international trade positions between countries. This is made possible because the trade market is an over the counter interbank market, that can facilitate transactions between many traders through brokers.

Forex is based on the concept of floating currencies in the open exchange market, in what is called the international money markets where the participants are Banks, Brokers, Fund Managers, Governments, Central Banks & individual speculators. The value of currencies is determined by demand supply forces and a country monetary policy. Other factors which affect currency value is the political stability of the country.

Trade for speculators

Until recently, Trade was only available to professional traders from major and international commercial banks, investment banks, money managers, registered FX dealers, international money brokers and large multinational firms. Now that forex is available online traders want to know What is Trade?

But with the emergence of internet and brokers, speculators and retail traders can now participate in the market, through retail brokers.

These days with the presence of Desktop computers & easy access to internet everywhere, online forex trade has become very popular. There are so many Forex online brokers available on the internet.

Traditionally Trade was only available to only the rich who had capital of more than $1 million. However with the growth of internet brokers are now able to provide retail Trade accounts that can be opened with as little as $100 and traders can trade currencies over the internet.

The forex trader only needs to download a brokers online Trade software then open an account with the broker and then start to trade currencies online via the online fx broker.

Trade - How to Start Trade

Trade is not centralized like the futures market or the stock exchange markets. Currency trade positions occurs over multiple computers and phones at thousands of locations globally, through inter-network of banks known as interbank network.

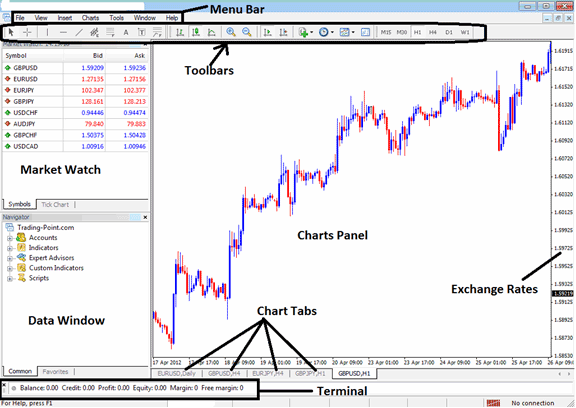

Trades are placed from Online Trade Platforms like the one below.

The trade market commonly referred to as Forex is where banks, investors, speculators and other trade market participants, exchange one currency for another. The largest trade activity in the forex is between the five major currencies:

- US Dollar

- British Pound

- Japanese Yen

- Euro and

- Swiss Franc

The Trade is also the largest financial market worldwide. In comparison to US stocks which trades $700 billion dollars per day the trades upto $7.2 trillion dollars in a single day.

The trade market is open 24 hrs a day & currencies are exchanged in the Inter-bank market. The trade market follows the clock around the world, moves from the major banking centers in the United States of America to those in Australia & New Zealand then to those in Asia, then to Europe & then back again to those in the USA.

Until now, only professional traders from the major international commercial/investment banks used to dominate the Trade market. Other market participants who've now joined in range from big multinational corporations, registered dealers, international money brokers, global money managers, futures trader, options traders, retail traders & private speculators.

There are 3 main reasons to participate in the market

- One is to facilitate an actual transaction, where the international corporations convert and cash on the profits made in the foreign currencies in to their local domestic currency.

- Corporate treasurers and money managers also trade Forex so as to hedge against unwanted exposure to future price action movements in the trade market.

- The third and most popular reason is based on the speculation for trading profit. In fact, it's estimated that less than 5% of the total trade position activities on the trade market is what actually facilitates commercial transaction, the other 95% is speculation based transactions retail Trade.

The forex market is regarded as an Over-the-Counter (OTC) or 'Inter-bank' market, depending on the fact that trades are conducted between 2 counter-parties over an electronic network.

Global Trade Hours

Trade market is not centralized within any exchange center, as the case with stocks and futures markets. Trade is a true 24 hour market, where the Trade day begins in Sydney, then to Tokyo, London then New York, all around the globe. When it comes to global trade market, traders can respond to forex currency exchange rate fluctuations caused by economic, social and political events at the time they occur, day or night.

How Do I Begin Trade

If you are looking for a new way of investing your money look no further than Trade. Many individuals have turned to trade activities to replace their stock trade transactions activities and to supplement their income. When done correctly, you as a trader can make good returns on your investment.

What is FOREX?

FOREX is short for trade market. The best way to understand what is FOREX is to think of it as buying and selling money. This is done through the international trade market.

Participants of the trade market buy a particular currency & sell it when it is favorable to do so. Your best chance as a learning trader is to understand analyze the trends so you as a trader can pick and trade a trending currency, whether it's the Japanese Yen, the Euro, or another currency.

Practice Trade on Demo Account

Because there's real cash involved in Trade, it is logical that many individuals are hesitant to join in on the market. The good news is that there are a number of different ways to practice trading without investing/depositing real money. You should read and study up on the various trade techniques like practice practice trading accounts and extensively do your homework. When you are ready, download a Trade platform and give it a try.

During the demo period, you as a trader can use virtual money(like monopoly board game money) to trade currencies. You can use this time to better understand forex market and how to use the software & technical tools. There are many web resources that you as a trader can find that offer information on the trade market and how you as a trader can analyze the information and predict changes in currency prices. Once you as a trader have a good Trade system and a reliable Trade plan that you use & it is profitable on a demo account you then can try to trade with real money.

What's the Risk?

As with any financial investment, there are risks. Even if you research vastwide forex trade techniques, study trends, and learn how to predict changes in the market trend, things can still go wrong. The best advice here is to use your head and better judgment, and most important use forex money management principles. Many people will see the power of leveraged currency trade within a few hours and then get greedy and go in over their heads and take risks and then lose their investment because they do not have an investment strategy or a Trade plan. As a forex trader, you'll have to learn when to trade and when not to trade. Many traders become too greedy and overtrade or hold on to a losing forex trade for too long.

You can use a stop loss order to exercise better control of your trade activities and limit your losses and risks to the down side. You can set up automatic stop orders and the platform that will close out an open forex trade when this target is hit. This also goes both ways: you as a trader can set an upper limit to take profit and a lower limit to stop losses.

How to Begin Forex

Where to Trade FX? - Most popular way to trade the online Trade market is to do it online from your home PC computer or office Desktop PC computer which has got a Trade platform and a fast inter-net connection. This way you'll have greater control and access to your investments through the trading platform & you as a trader can make changes or adjustments at any time of the day or night. Online forex trade platforms have become a great way of participating in the online forex trade market, so you'll not find it hard to find Trade platforms or brokers online.

Always test the software using a practice demo trade account to ensure that you are comfortable with it.

What is Trade Online? - What's Trade? - How Do I Trade? - How to Start Trade - What is Trading & How Does It Work? - What is Trade Demo Account? - What is Trade Real Account? - Learn What is Trade?

Learn More Tutorials and Courses: