What's Ehler MESA Adaptive Moving Average Indicator?

Ehler MESA Adaptive Moving Average - Ehler MESA Adaptive Moving Average indicators is a popular forex indicator which can be found in the - Indicators Listing on this website. Ehler MESA Adaptive Moving Average is used by the FX traders to forecast price movement depending on the chart price analysis done using this Ehler MESA Adaptive Moving Average indicator. Traders can use the Ehler MESA Adaptive Moving Average buy & Sell Trading Signals explained below to figure out when to open a buy or sell trade when using this Ehler MESA Adaptive Moving Average indicator. By using Ehlers MESA Adaptive Moving Average and other forex indicators combinations traders can learn how to make decisions about market entry and market exit.

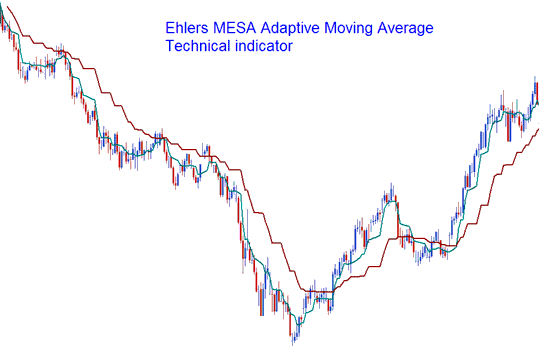

What is Ehler MESA Adaptive Moving Average Indicator? Ehler MESA Adaptive Moving Average Indicator

How Do You Combine Indicators with Ehler MESA Adaptive Moving Average? - Adding Ehlers MESA Indicator on the MT4 Software

Which Indicator is the Best to Combine with Ehler MESA Adaptive Moving Average?

Which is the best Ehler MESA Adaptive Moving Average combination for forex trading?

The most popular indicators combined with Ehler MESA Adaptive Moving Average are:

- Relative Strength Index

- MAs Moving Averages Indicator

- MACD

- Bollinger Bands Indicator

- Stochastic

- Ichimoku Indicator

- Parabolic SAR

Which is the best Ehler MESA Adaptive Moving Average combination for Forex trading? - Ehler MESA Adaptive Moving Average MT4 indicators

What Indicators to Combine with Ehler MESA Adaptive Moving Average?

Get additional indicators in addition to Ehler MESA Adaptive Moving Average that will determine the trend of the forex market & also others that confirm the market trend. By combining forex indicators which determine trend & others that confirm the trend and combining these indicators with Forex Ehler MESA Adaptive Moving Average a trader will come up with a Ehler MESA Adaptive Moving Average based system that they can test using a demo account on the MetaTrader 4 platform.

This Ehler MESA Adaptive Moving Average based system will also help traders to figure out when there is a market reversal based on the technical indicators signals generated and thence trades can know when to exit the market if they have open trades.

What is Ehler MESA Adaptive Moving Average Based Trading? Indicator based system to analyze and interpret price & provide signals.

What's the Best Ehler MESA Adaptive Moving Average Forex Strategy?

How to Choose & Select the Best Ehler MESA Adaptive Moving Average Forex Strategy

For traders researching on What is the best Ehler MESA Adaptive Moving Average forex strategy - the following learn forex guides will help traders on the steps required to course them with coming up with the best strategy for forex market based on the Ehler MESA Adaptive Moving Average system.

How to Develop Ehler MESA Adaptive Moving Average Forex Systems Strategies

- What is Ehler MESA Adaptive Moving Average Trading Strategy

- Creating Ehlers MESA Adaptive Moving Average Forex Strategy Template

- Writing Ehlers MESA Adaptive Moving Average Forex Strategy Trading Rules

- Generating Ehlers MESA Adaptive Moving Average Forex Buy & Ehler MESA Adaptive Moving Average Sell Trading Signals

- Creating Ehlers MESA Adaptive Moving Average Trading System Tips

About Ehler MESA Adaptive Moving Average Example Explained

Ehler MESA Adaptive Moving Average Technical Analysis Signals

Mesa Adaptive MAs Moving Averages was created by John Ehler

Originally used to trade commodities and stocks.

The MESA Adaptive average resembles 2 MAs Moving Averages. The difference is the MESA moves in a staircase manner and not in a curved line like the MA Moving Average. The illustration put on display below shows this technical indicator plotted on a price chart.

Ehler MESA Adaptive MA

The MESA Adaptive Moving Average is a price trend following technical indicator that adapts to price action movement based on the rate of change of price as gauged by the Hilbert Transform Discriminator. This indicator will generate a signal when the two MAs Moving Averages cross one another. Trades should be opened in the direction of MESA averages.

This method features a fast Moving Average & a slow Moving Average so that composite average quickly follows behind the price changes and holds the average value until the next candle close occurs. This indicator is less prone to fake outs compared & analyzed with the original Moving averages. This is due to and because of the formula used in calculating the rate of change relative to the price movement.

Study More Topics & Courses:

- How Can I Add USD SEK Symbol to MT4 Platform/Software?

- MACD Hidden Bullish and XAUUSD Hidden Bearish Divergence Trade Setups

- McGinley Dynamic Tutorial

- How Can I Print Trade Forex Charts?

- How to Find and Get MT4 EURPLN Chart

- Keltner Bands FX Technical Indicators Lesson Guide

- How to Find and Get MT4 Silver Forex Chart

- How to Generate Signals for Gold

- How Do I Trade Strategy Signals?

- How to Trade UK100 Index Trade Strategies Lesson Guide