INDICES TRADING PLAN - EXAMPLE OF STOCK INDICES TRADING PLAN

Below is an illustrated example of an indices trading plan template that traders can customize to suit their strategies.

JUSTIFICATION FOR A TRADING PLAN

1. Trading Is a Business and Winners Always Make a Plan

- Businesses that are successful always begin with a plan.

- Successful biz plan will guide you to success, think of your plan as a map - it's a constant reminder of how you'll consistently pull profits from the trading stock indices market .

- Difference between a successful Indices trader and a losing trader is the plan.

2. TO KEEP ME IN THE RIGHT DIRECTION

Consistency is key in your trading routine to measure how successful you are as a trader.

Keep you on target, read and study it every day & stick to it.

YOUR SUCCESS IS GUARANTEED IF YOU POSSESS A SOUND TRADING PLAN AND EXERCISE SUFFICIENT DISCIPLINE TO ADHERE TO IT RIGIDLY.

INDICES STRATEGY

Our Stock Index approach is exclusively geared towards initiating bullish trades. This is founded on the principle that stock values tend to appreciate over the long term: consequently, the indices tracking these stock movements are generally expected to trend in an upward direction over extended periods. To execute a buy trade, we will await a price pullback and buy at those dips.

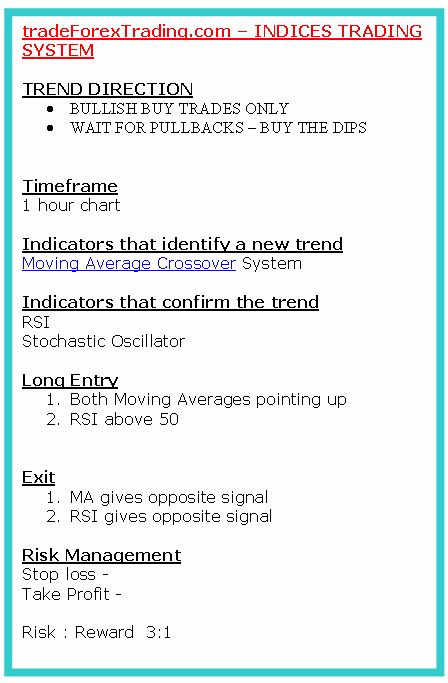

TREND DIRECTION

· BULLISH BUY TRADES ONLY

· WAIT FOR RETREATS - PURCHASE THE DIPS.

TRADING SYSTEM

GOALS OF THE SYSTEM

- Ability to IDENTIFY TREND AS EARLIEST AS POSSIBLE .

- Ability to AVOID WHIPSAWS .

A Trade System should find a compromise between the two Goals,

Find ways to spot price trends early. Also, learn to tell real signals from false ones like whipsaws.

Roles of Each Part in the Indicator

Spot a new market trend as early as possible in Massachusetts.

RSI Application: Confirming the Commencement of a New Market Direction

TIMEFRAMES

- Main timeframe is the 1H.

- Signals are derived/generated on the 1H time frame.

1H

- 5 & 7 L MA

- RSI (14)

RULES

LONG ENTRY

1H Chart

- Both Moving Averages are moving UP

- RSI greater and higher than 50

LONG EXIT

- MA generates in the opposite trend signal

TRADE ROUTINE

- Signals are generated using 1H time frame.

- Signals to be executed immediately the trading rules are met and matched ( Not Before ) .

- Entry signals should be executed during the day-time.

- Close all trade transactions at the end of the day.

TIME OF THE DAY TO TRADE MARKET

Watch market during the day-time

MONEY MANAGEMENT

· Day trading - Low risk High return method

· Trade when I have a high risk reward ratio 3:1 or more

· Never trade more than 10 % of account total account balance

· Never risk more than 2 % on one trade position.

MINDSET & PSYCHOLOGY

- Trade without Emotions (greed, fear, anticipation, impulse, bias, over-excitement)

- I trade what my eyes see & not what I feel.

- I'll be patient.

My responsibility does not include being the system!

It's not to make a decision which trades looks promising and which does not.

That's the job of my system. My system has a set of rules which tell me this is what I follow. Do not get caught-up in the price action & make your own rules as you go along.

MY JOB IS

to be patient and wait for my system to indicate when it's time to enter or exit. I then carry out the trade position as intended, with the utmost focus.

The typical results of making trades that the trade system doesn't provide, second-guessing the system, not taking trades that are given, hesitating and entering late, and anticipating and entering early are all due to a lack of faith in the system and a lack of urgency in carrying out transactions accurately.

Goal: Build full focus to master my indices system. Execute it with perfect accuracy.

The better you get at stepping back from market moves and watching calmly, the easier it is to spot your emotions. Wait for a clear trade signal. Don't let feelings pull you in and mess up your plan.

WEAKNESS

- I am greedy.

- I over-trade

- Make a list of all your weaknesses which are interfering with your trading. This is the first step to help you to over-come the these weak-nesses. Use psychology to help you overcome them.

Note: As you trade, you will start to notice your flaws if you write them down: once you do this, you will begin to avoid these errors, and your trading will get better.

GOALS

- To focus on the exit signal just as much as I do on the entry.

- Always protect my account using stoploss order, money management strategies, trading with the trend and always following the trading rules of my system & plan.

- Never second guess or go against my system. To always keep up my discipline.

- Follow all the rules of my system and never break them.

- Trade fewer times and execute all my trade transactions correctly. Trade what I see, what the trading system + charts are telling me.

- Sit patiently and wait out for signals from my strategy.

- Achieve consistent profitable results.

Write down goals and focus on achieving these goals and objectives on your trading

ADHERE TO THIS TRADING SYSTEM.

This is the most vital part of making the system.

Always follow the rules

Adhere strictly to the established trading protocols.

Maintain discipline and exercise patience.

JOURNAL

I will meticulously log all executed trade activities in a dedicated journal to monitor my advancement.

Discover Extra Subjects & Educations:

- Trend line Break Reversal

- How to Add MT4 Linear Regression Acceleration in MT4 Chart

- What's the Difference between Market Order and Stop Order and Limit Order?

- MT5 Moving Average Indicator

- Ehler MESA Adaptive Moving Average XAU/USD Indicator

- What is Margin Call XAUUSD Definition?

- Example of Index Forex Trading Plan

- Forex Indicators Explained with Chart Examples

- How Can I Use the Fractals Indicator When Trading?