How Do You Predict Charts using Charts Patterns Analysis?

How Do You Predict Charts Movement using Charts Patterns Analysis?

There are 3 types of charts used in Forex: Line Chart, Bar Chart and Candle-sticks Chart - How Do You Predict Charts.

How Do You Predict Charts?

Line Charts line charts plot a continuous line connecting closing prices of a instrument.

Forex Line Charts - How Do You Predict Charts

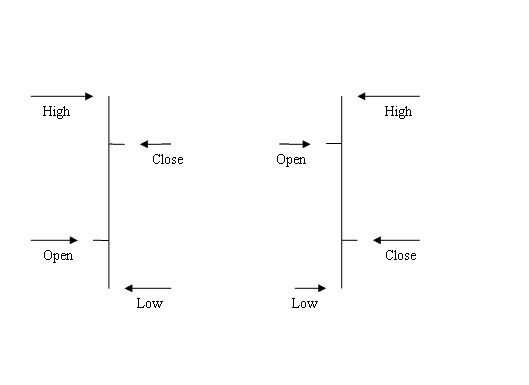

Forex Bar Chart - forex bar charts are highlighted as sequence of OHCL bars. O H C L represents OPEN HIGH LOW and CLOSE. The Opening price is displayed as a horizontal dash to the left and closing price as a horizontal dash to the right.

Forex Bar Charts -

The main disadvantage of bar chart is that it is not visually appealing, therefore most traders do not use them.

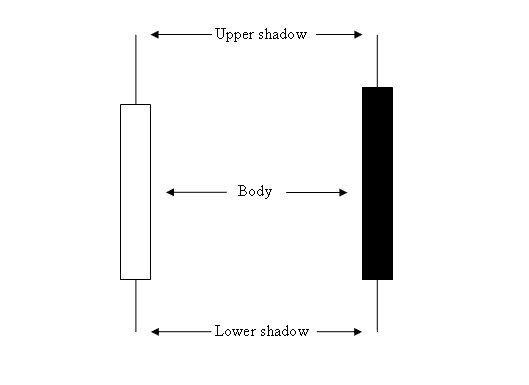

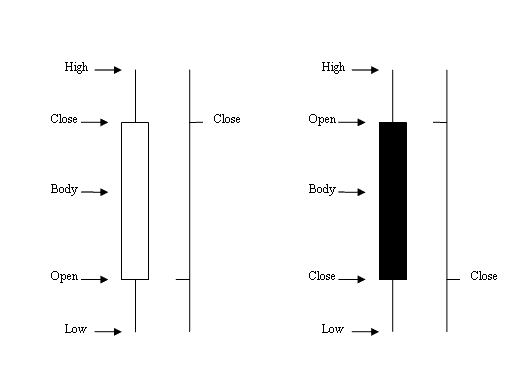

Candle-sticks Charts - these candlesticks charts use the same price data as bar charts (open, high, low, & close). However, they are illustrated in a much more visually identifiable way which resembles a candlestick that has wicks on both ends.

How Do I Analyze Candlesticks Charts?

The rectangle part section of candlestick is referred to as the body.

The high & low of the candlestick are called as shadows and are drawn as poking lines.

Candlesticks Charts

The color of candlestick is either blue or red:

- (Blue or Green Color Candles)

- (Red Color Candles)

Most softwares like the MT4 Software, use colors to mark the direction of price. Candles colors used are blue or green: when price moves upwards, color of candlestick is blue: when price moves downward, color of candlestick is red.

Candlesticks Charts vs Bar Charts

When candlesticks charts are used it is very easy to see if the price moved up or down as opposed to when bar charts are used.

The Japanese candles charts techniques also have very many candles formations that are used to trade the Markets. These setups have different technical analysis interpretation and the most common are:

| Reversal Patterns Candlesticks Patterns Forex Candles Setups |

Forex Charts Online Course Beginner Traders Guide Beginners

The above candlesticks patterns is what makes the Japanese candlesticks chart patterns popular among traders & it is why this type of chart analysis analysis are most widely used in analyzing the market.

How Do You Predict Charts using Charts Patterns Analysis?