How Do You Analyze/Interpret Bull Flag Setup?

How Do You Trade Bull Flag Setup?

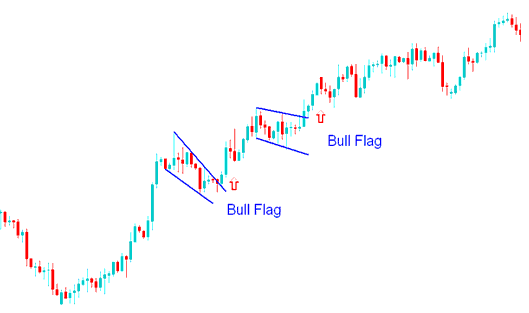

A bull flag formation constructs a pattern resembling a rectangle tilted slightly downward. This rectangular area is defined and shaped by two parallel lines functioning as resistance and support levels for the price until a decisive breakout occurs. Generally speaking, the bull flag chart pattern will not be perfectly horizontal but will exhibit a modest downward slope.

You can see the bull flag pattern when prices are generally going up. The bull flag is a pattern that shows things will likely keep going as they have been, where prices go down a bit, the bull flag chart pattern is then a small drop in price with not much movement, which goes down a little bit. You get the signal to buy when the price goes above the top line of the bull flag chart pattern. The flag part of the bull flag pattern has high and low prices that you can link with short lines that are side by side, and it looks like a small channel - flag.

A bull flag pattern occurs midway through a bullish trend: following a breakout, price movement is likely to mirror the height of the flagpole.

How Do I Analyze Bull Flag Pattern?

The bull flag pattern depicted earlier signified a pause as the market gained strength to breakout and rise further. The continuation signal for this bull flag pattern was validated when the upper boundary was breached on the upside, prompting a further increase in price.

How Do You Analyze Bull Flag Pattern?

More Topics & Courses:

- Want to open a real FX trading account? Here's what to do.

- Procedure for Configuring the AUDCAD Chart within MT4 Software

- Forex Method is a Method That is Used to Interpret/Analyze Currencies

- MetaTrader Forex Signals with Automatic Trade Signal Copier Execution from MQL5

- Defining Forex Signals that Suggest Buying or Selling Based on Momentum