How Do I Trade Chart Break out Pattern?

How Do I Identify Chart Breakout Patterns and Confirm Break Out Signals Technical analysis of Charts

How Do You Trade a Chart Break Out Pattern in Forex?

The Best Patterns Course for New Traders - How to Identify and Trade Chart Breakout Chart Pattern

Chart Patterns for Day Trading - Trading Patterns Chart Break Out Signals

This Chart Break Out Pattern patterns charts guide explains how to identify patterns - identifying chart patterns is the first step when it comes to learning how to trade with Chart Break Out Pattern chart patterns in Forex.

Chart Break Out Pattern price patterns commonly form on charts and this chart pattern analysis guide explains how to trade & analyze charts using Pattern Break-out chart patterns.

Chart Break out Pattern

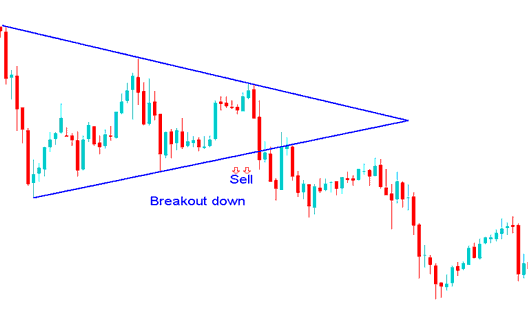

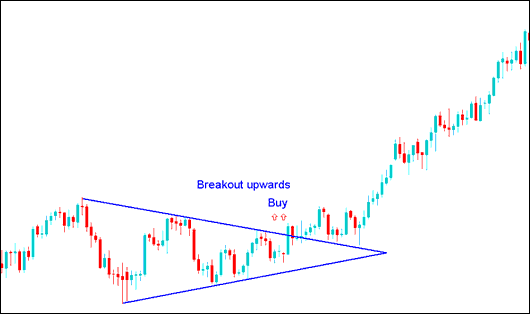

The consolidation chart pattern can't go on forever & just like in a tug of war one side eventually wins, looking at currency chart below see how the consolidation pattern eventually had a breakout and moved in one direction. Now how do we as traders ensure that we are on the winning side?

How Do You Trade Chart Breakout Pattern?

How Do I Trade a Chart Break Out Pattern in Forex?

How Do You Trade Pattern Break-out Pattern

Well we wait til price moves past one of the consolidation pattern lines & put buy or sell orders in that direction. After consolidating, If price breaks-out the upper line we buy, if it breaks-out out the lower line we open sell.

Alternatively if you do not want to wait out the consolidation pattern, you can use pending orders. If you would want to learn more about pending orders go to the lesson: FX Stop Entry Order Types

The two types of forex stop order types used to trade consolidation setups are:

- Buy Entry Stop A pending order to open buy at a level above market price - after an upwards price break out.

- Sell Entry Stop An order to open sell at a level below market price - after a downwards price break out.

These are orders to open buy above the market or to open sell below the market.