Price Action 1.2.3 method in the Market

Price action trading for XAUUSD uses only charts, no indicators. It relies on candlestick patterns, lines, and setups like the 1-2-3 pattern or bar sequences.

Traders use this plan because it's very neutral, letting them study gold market moves by just watching the charts and seeing how the market moves.

This trading strategy is used by many traders: even those that use technical indicators also integrate some form of price action in their trading strategy.

The most effective way to use this method is to combine the resulting signals with line tools, which will help give extra confirmation. These line tools are trend lines, Fib retracement, and support and resistance zones.

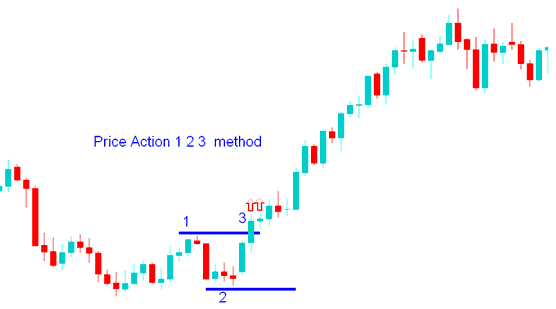

Price Action 1-2-3 Breakout

This strategy employs three chart points to predict breakout directions in XAUUSD trading. Using peak and trough formations as points 1 and 2, the method signals a long trade if the market exceeds the peak and a short trade if it drops below the trough. Breakouts beyond points 1 or 2 establish the third key point for decision-making.

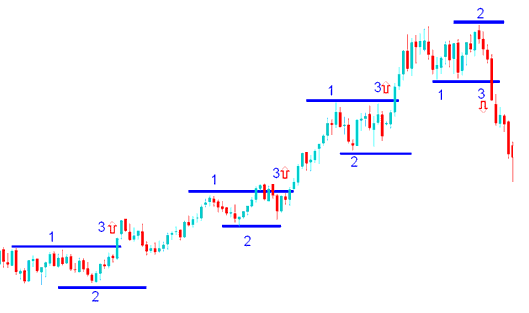

Series of break outs on Chart

Investors utilize price action to forecast potential trend directions. The market can either be trending or ranging.

A trending market moves in one direction. A range-bound market moves sideways after support or resistance.

Price action tells if the market trends, stays in range, or turns around.

Like other XAUUSD methods, pair this with extra indicators to cut false signals. The 1-2-3 pattern works well in trends but fails in flat markets. Check the trend first before using it.

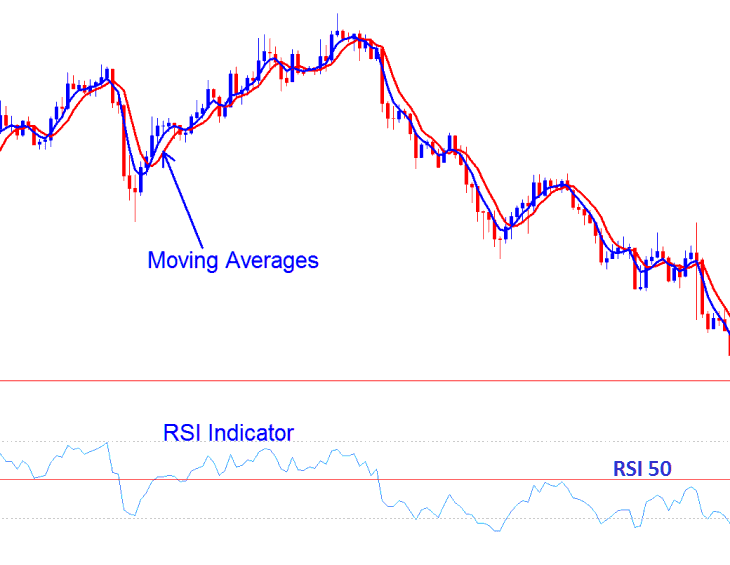

Combining This Strategy with other Indicators

Excellent factors to combine with are:

- RSI

- MA Indicator

Investors should use these 2 indicators to confirm if the direction of breakout is in line with the trend direction displayed and illustrated by these 2 indicators. If the direction is also the same as those of these indicators then investors can open a trade in the direction of signal. If not investors should not open a trade as there is more likely a chance that this signal may be a xauusd whipsaw.

Like other tools for XAUUSD, price action can have false signals. You need to pair this method with extra trading clues, not rely on it solo.

Combining with other Technical Indicators - RSI and Moving Averages

More Topics & Courses:

- How to Use MetaTrader 5 Trend Trigger Factor TTF Indicator

- How to Use MT5 T3 Moving Average on MetaTrader 5 Platform

- Awesome Oscillator Expert Advisor(EA) Setup

- A Definitive Course for Trading the FTSEMIB40 Stock Indices

- 3 Types of Stochastics Oscillators, Fast Stochastic, Slow Stochastic and Full Stochastic Formula

- Different Strategies for Forex Money Management