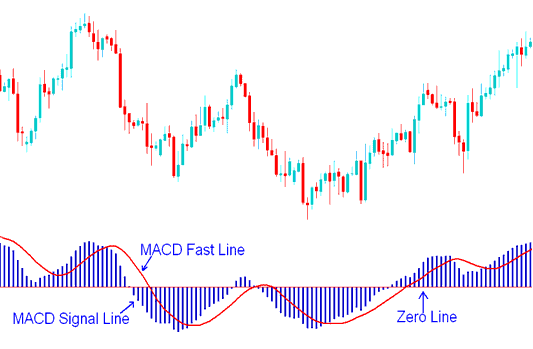

MACD Oscillator Technical Analysis Fast Line & SignalLine

MACD is used in various ways to give trading analysis data.

- MACD center line crosses show bullish or bearish markets: below the zero is bearish, above zero is bullish.

- MACD Cross-overs indicate a buy or sell signal.

- Oscillations can be used to indicate over-sold and overbought regions

- Used to look for divergence between price & indicator.

Construction of MACD

The MACD is made with two special MAs, and it shows two lines on a chart. The standard special MAs used are 12 and 26. Also, a smoothing factor of 9 is used when drawing the MACD technical indicator.

Summary of how MACD is drawn

MACD uses 2 EMAs + a smoothing out factor (12, 26 Exponential MAs Moving Averages & 9 smoothing periods)

MACD only plots two lines - the MACD fast line and the MACD signalline

MACD Lines - MACD Fast Line & MACD SignalLines Signals

- The Fast-Line is the difference between the 26 EMA & 12 EMA

- The SignalLine is the 9 period moving average MA of the MACD fast line.

Implementation of MACD

MACD shows the MACD line as a normal line, but the signal-line is shown as a bar graph. These two MACD LINES create signals using the crossover strategy.

There is also the MACD center line which also is known as zero mark & it's a neutral point between buyers & sellers trading the market.

Values that exceed the center mark are interpreted as bullish signals, whereas those that fall below are seen as bearish signals.

As an oscillator, the MACD exhibits fluctuations both above and below its central reference line.

Learn More Tutorials & Tutorials:

- 1:100 Leverage vs 1:500 Leverage Described

- Linear Regression Slope Technical Analysis

- How Do You Add Moving Average MA Oscillator Gold Indicator on Moving Average(MA) Oscillator for XAUUSD Analysis?

- Automated System Development

- Strategy for Trading SWI 20 in FX

- Awesome Oscillator MT5 Trading Analysis

- XAU/USD News Strategies Guide Lesson

- MetaTrader CAC Stock Indices CAC 40 MetaTrader 4 Platform Software

- How to Login to MT5 Practice Demo Practice Account & MetaTrader 5 Live Account in MT5 iPad App

- XAU/USD MetaTrader 4 Platform Software Download Guide