MACD Hidden Bullish and Bearish Divergence Trade Setup

MACD Hidden divergence is used as a possible sign for a trend continuation.

This MACD hidden divergence forms when price pulls back to test a past high or low. It has two main types.

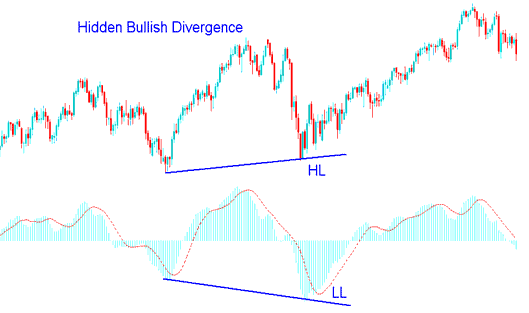

1. Hidden Bullish Divergence

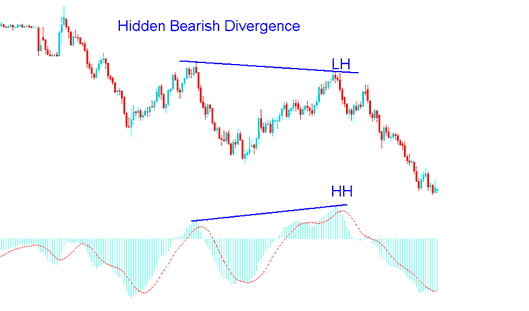

2. Hidden Bearish Divergence

XAU/USD Hidden Bullish Divergence in XAUUSD

The MACD Hidden bullish divergence trading pattern occurs when the price is creating/forming a higher low (HL), but the MACD oscillator's technical analysis is indicating a lower low (LL).

A hidden bullish divergence setup occurs when there is a retracement within an upward trend.

A Trading Strategy centered on MACD Bullish Divergence - Setting up Trades based on MACD Bullish Divergence.

This MACD bullish trade divergence setup confirms that a retracement has been completed. This divergence illustrates the underlying strength of an upward trend.

XAU/USD Hidden Bearish Divergence in XAUUSD

MACD hidden bearish divergence hits with price at a lower high. Yet the MACD shows a higher high.

A hidden bearish divergence setup occurs when there is a retracement within a downward trend.

A Trading Strategy Based on MACD Bearish Divergence – Setting Up Trades Using MACD Indicator Bearish Divergence.

This MACD hidden bearish divergence means the pullback has ended. It highlights the downtrend's strength.

NB: Hidden divergence works best because it gives a signal that matches the direction of the current trend. It allows for the best possible entry point and is more reliable than the usual divergence setup.

Study More Topics and Guides:

- Analyzing Choppiness Index with MetaTrader 5 in Trading Charts

- What is the DAX30 Indices Chart in MT4?

- Analysis of Darvas Box in Forex Charts

- Putting Together the Recursive Moving Trend Average Indicator

- Trading the IBEX35 Stock Index on Both MT4 and MetaTrader 5 Platforms

- How Do You Add the FTSE MIB40 to the MetaTrader 4 Android App?

- How to Work with MT4 Choppiness Index Tool on MT4?

- Trading with the Fibonacci Extension Indicator in MetaTrader 4: Methodology Explained

- Ideal Trading Times (in GMT) for Transactions Involving EURDKK

- Instructional Courses for HSI 50 Trading Strategies