RSI Divergence Technical Indicator Analysis

RSI indicator is one of the often used divergence indicator. This xauusd indicator is an oscillator technical similar to the RSI & it can be used to trade divergence setup just the same way as the RSI indicator.

RSI Gold Technical Analysis & RSI Signals

RSI Divergence Indicator

RSI Divergence Technical Indicator

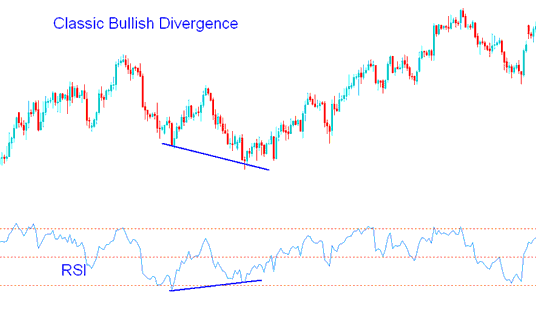

Classic RSI Bullish Divergence Setup

RSI classic bullish divergence setup occurs when the price is forming/making lower lows (LL), but RSI indicator is making/forming higher lows (HL).

XAU/USD Classic Bullish Divergence - RSI Divergence Lesson Guide

RSI indicator classic bullish divergence warns of potential reversal in the market trend from downward to upward. This is because even though the price headed lower the volume of sellers who moved the price lower was less like is illustrated/shown by RSI indicator. This shows underlying weakness of the downward trend.

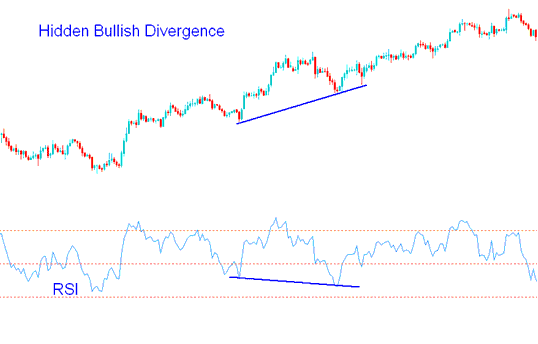

Hidden RSI Bullish Divergence Trading Setup

Forms when the price is making/forming a higher low ( HL ), but RSI is making/forming a lower low (LL).

RSI hidden bullish divergence trade setup occurs when there's a retracement in an upward trend.

XAU/USD Hidden Bullish Divergence - RSI Divergence Lesson Guide

This setup confirms that a retracement is complete. This RSI divergence demonstrates under-lying power of an upwards trend.

RSI Divergence Technical Indicator

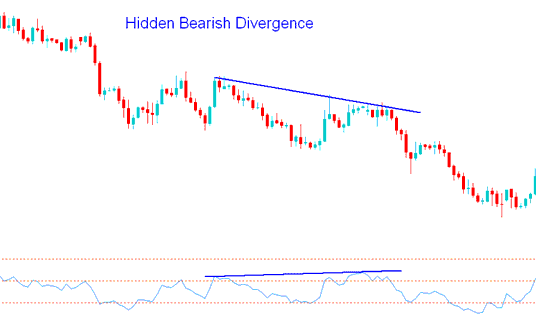

Hidden RSI Bearish Divergence Setup

Occurs when price is making lower high (LH), but the oscillator indicator is showing and displaying a higher high (HH).

Hidden bearish divergence forms when there's a retracement in a downwards trend.

XAU/USD Hidden Bearish Divergence - RSI Divergence Lesson Guide

This setup confirms that a retracement is complete. This divergence indicates the under-lying momentum of a downwards trend.

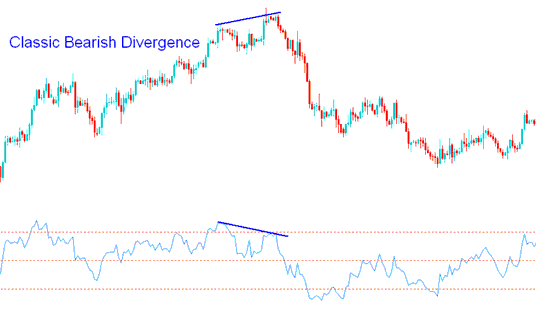

RSI Classic bearish Divergence Trading Setup

RSI classic bearish divergence occurs when price is making/forming a higher high (HH), but RSI is forming/making lower high (LH).

XAUUSD Classic Bearish Divergence - RSI Divergence Lesson Guide

RSI Classic bearish divergence signals a possible reversal in the trend from upwards to downward. This is because even though the price headed higher the volume of buyers who moved the price higher was less just as is shown and shown by the RSI indicator. This shows underlying weakness of the upward trend.

Learn More Topics and Guides:

- How to Find EURO STOXX 50 in MetaTrader 5 PC

- GBPCAD Spreads Explained

- How Do I Trade Forex Divergence & How to Trade Divergence Setups in Trading?

- What's Index in Trading?

- How Do I Trade Stocks on MetaTrader 4 Software Platform?

- Ultimate Oscillator XAU/USD Indicator Analysis in Gold

- What is HSI50 Strategy? Tutorial for HSI50 Indices

- What's FX Currency Pairs Spread?

- How to Analyze MetaTrader 4 Charts Explained and Described Beginners Lesson Tutorial