Gold Trading Long and Short & Charts

In XAUUSD, there are two types of trades, these are:

- Long (buy) - long is if the price trend is buy/bullish.

- Short (sell) - short is if the trend is sell/bearish.

Buying long means open to rise. Selling short means open to fall. Both start trades.

Buying Long = term to use when buying and when opening a position.

Selling short = term to use when selling and when registering and opening a position.

Going “long” just means buying. If a trader goes long, they're buying the gold pair because it's trending upward. When prices are climbing, that's called a bullish market.

Short - this just means selling a gold pair when the price is dropping. When the market's heading down, that's called a bearish trend.

In online Gold trading environments, the term "selling short" can directly apply to the sale of XAUUSD. Short selling is a strategy for trading an asset, such as XAUUSD, that is expected to lose value relative to another asset. Selling this instrument is equivalent to holding no value in it while maintaining equivalent value in the other currency. In our contextual example, this means selling XAUUSD while holding a corresponding value in US Dollars.

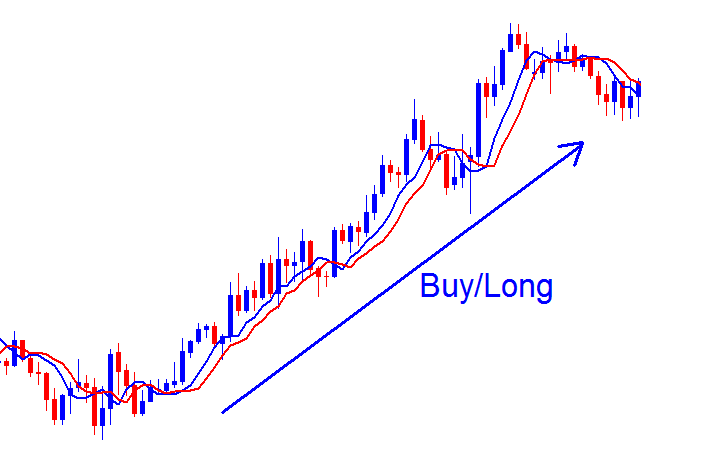

Buy/LongIf the price goes up, we buy: this is known as going long. So, long is just another way to say buy. When the price is generally moving higher, it is known as a bullish trend, and that is when a buy order is placed. A bullish trend can be seen by drawing a line that goes up on a Gold trading chart. The example shown below shows a signal to go long, or buy.

Buy/Long

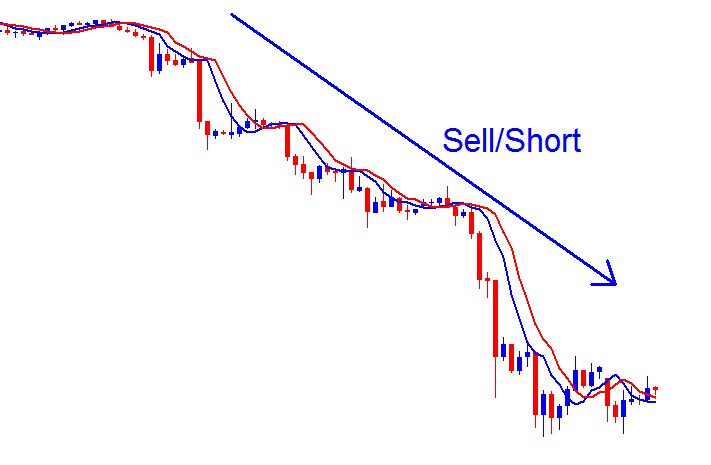

Sell/Short If the price of Gold is going down, we sell, which is known as going short. When the price is going down, it's called a bearish trend. The example below shows a downward trend, which is when a short sell is done. The short/sell is shown by drawing a downward line on a chart. The example below shows a short/sell trade signal.

Gold ChartsA depiction of the XAUUSD exchange rate (plotted on the vertical y-axis) against the timeline (mapped on the horizontal x-axis) for a specific forex instrument, in this context, Gold, is presented through a chart. These trading charts illustrate the fluctuation of prices. As demonstrated below, charts can take the form of candlestick charts, line charts, or bar charts.

XAUUSD Chart

The three most used chart types for the XAUUSD Market are:

- Candlestick Charts

- Line charts

- Bar charts

These 3 types are discussed and discussed in the lesson XAUUSD Chart Types.

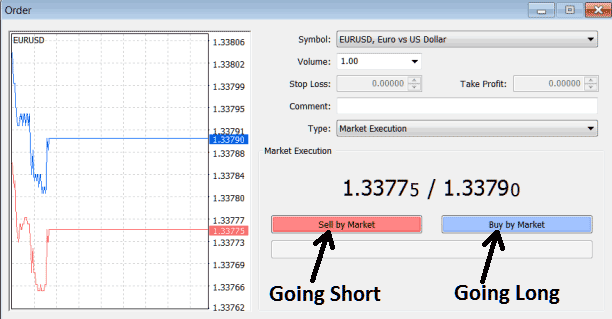

Putting Buy Long and Sell Short on MT4 Platform

Gold Trade Software. This platform comes from an online broker. It lets traders make deals in the online gold market. Download and install it on your computer to start trading gold and forex. The platform runs all your trades. If you want to learn trading software, begin with MT4.

To put in these requests to buy and sell, start MT4, open a "chart", click the right mouse button on the "chart", pick the "New Order", then pick the gold trade request to either buy or sell like it is shown below. (Use 'F9' as a Shortcut)

Discover Extra Instructions & Explanations:

- Guide to Analyzing Fibonacci Projections Indicator in MT5

- Analyzing XAUUSD Price Movement with Bollinger Bands During Gold's Sideways or Ranging Markets

- Day Gold Strategy

- Understanding RSI Indicator Formations and RSI Index Trend Trajectories

- Index Trading Strategies AEX

- Utilizing Bollinger Bands and Fibonacci Ratios as Indicators in MT4

- How to Calculate Pips For SX5E Stock Index

- What's CRUDE OIL Spreads?

- Adding FTSEMIB 40 to MetaTrader 4 on Android