Details on XAUUSD Contracts, Including Leverage, Margin, Spread, Bid, and Ask Price

Lots and Contracts

XAUUSD (Gold) trades in standard contracts, or lots. One standard lot equals 100 ounces of gold - so, 100 units of XAUUSD.

The Gold contract size represents the amount of XAUUSD ounces to be traded in the online marketplace by traders. A standard Gold lot equals 100 ounces multiplied by XAUUSD's current market price. While physical gold isn't traded directly, these ounces are represented through contract agreements.

The two terms, 1 standard lot and 1 standard contract, can be used interchangeably since they both refer to the same entity.

Why Trade Units of Gold of 100 Ounces

The rationale behind employing such substantial lot sizes when trading Gold or the physical metal is to amplify the monetary value of each single pip movement (profit).

The XAUUSD price moves are measured in points also referred to as pips.

One point in XAUUSD equals one cent per ounce. Gold quotes like 1247.01 track small price shifts.

Last Digit Marks the Pip at Second Decimal.

XAUUSD trades in 100-ounce lots. This example below makes it clear why.

Gold Trade Example with 1 Contract: The XAU/USD metal will only fluctuate an average of $5 per day, which is equivalent to 500 points or 500 pips. Trading a single ounce of xauusd will only yield a profit of 500 points/pips multiplied by 1 cent, or $5, if one point is equal to 1 cent.

In online XAUUSD trading, traders do not buy or sell a single ounce of gold. XAUUSD trades in contracts or lots of 100 ounces each. So, when a gold trader takes one contract, it equals 100 times the value of one ounce shown in the earlier example. In that past case with one contract, if the XAUUSD price shifts by $5 or 500 pips, the trader's gain is not just $5. Since the contract covers 100 ounces of XAUUSD, the profit gets times 100. That makes the full gain $500, not $5.

This is the reason why Gold is traded in big sets of ounces – so that the profit per point goes up.

XAUUSD Contract

One XAUUSD contract is 100 ounces at $1247 each. That totals $124,700 based on the current gold chart.

To buy a single gold contract at today's price, you need $124,700 in your account. Not exactly pocket change. So, how's a regular trader supposed to get that kind of money?

How can a trader afford to invest $124,700?

That is a very good question: the answer is LEVERAGE & MARGIN

To trade Online XAUUSD, you don't have to have $124,700 Dollars: with leverage and margin, you only need $1,300 to trade one unit of XAUUSD, but how is that possible?

We shall explain using the example illustration shown:

Leverage & Margin

Trading Gold works the same way. A small deposit allows for much bigger trades. Gold (XAUUSD) traders use leverage to try and get bigger profits but still control risk, because they only risk a small part of their own money. For example, if you put down $1,300 and use 100:1 leverage, you're borrowing $100 for every $1 you put in. This means you're trading with a hundred times your actual money.

So, a trader who only has $1,300 in their account can borrow up to 100 times that amount, meaning that after borrowing, or using leverage, they will have $1,300 multiplied by 100, which equals $130,000. With $130,000 to control, the trader can then trade one contract of XAUUSD.

Leverage is shown as a ratio, like 100:1, which means that an online gold trading broker will give a gold trader $100 for every $1 they have. This means the broker lets the gold trader borrow up to 100 times more than what they put in. A leverage option of 200:1 means the broker lets the gold trader borrow up to 200 times the money they have in their account.

Margin - Margin is the amount of money required by your Gold broker to allow you the trader to continue trading with the leveraged amount. Margin is also the amount which you deposit when opening your account. For exemplification when you deposit $2,000 dollars then your margin is $2,000.

With leverage, everyday gold traders or XAUUSD investors can participate in the online gold market. A leverage ratio of 100:1 means that for every $1 you have in your account, you can borrow $100 from your online XAUUSD broker. However, this also means that you need to keep $1 in your account for every $100 you borrow.

Gold Contract Trade ExampleIf you deposit $1,300 in you trading account and your Gold broker gives you leverage option of 100:1 then it means that now you have $1,300*100 = $130,000 dollars that you can transact with & even buy upto 1 Gold contract.

Because you're controlling $130,000 with your $1,300, which is 1% of the total, your account's margin requirement is 1%.

A gold seller might say their margin is 1%, meaning you can trade with 100 times your money: if the margin is 2%, it means you can trade with 50 times your money (2% is $1 for every $50).

So, with leverage and margin as explained above, retail XAU USD traders don't have to put down all the money for the entire contract they want to trade. They can trade on leverage with the account they open, and this account is known as a margin account, meaning they're trading on margin, and the money in their account is the margin for the leverage they'll use for trading.

Spreads mark the gap between your buy price and the broker's sell price.

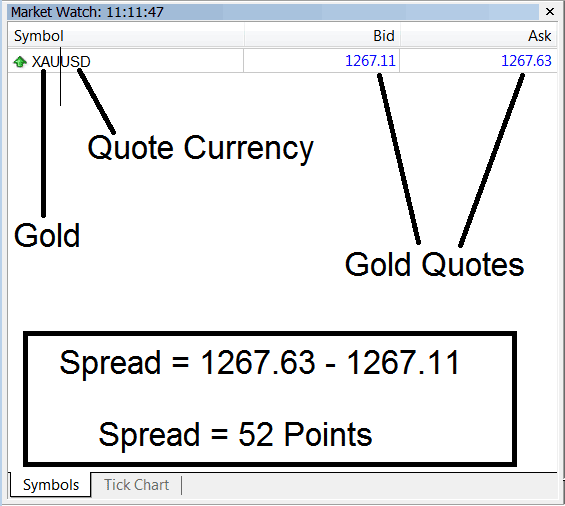

The spread just means the gap between the Bid Price and the Ask Price. You can use the Bid and Ask prices shown below to figure out the spread for trading XAUUSD, that's the gold metal.

Gold Trading Spreads on MT4 Platform

Example illustration of How To Calculate Gold Spreads

The Bid ASK Price of XAUUSD is 1247.11/1247.63

The spread is equal to 1247.63 - 1247.11 = 0.52

Spread is 52 pips

This spread is the profit that the Gold broker makes.

Bid/Ask Price

Bid Price Is Where You Sell

Ask Price Is Where You Buy

If the quote for EURUSD is 1247.11/1247.63Bid/Ask= 1247.11/1247.63

So: Bid Price =1247.11Ask Price =1247.63

Mini Lots and Micro Lots

It's worth noting that in Gold trading, a fraction of a standard Lot is available. Brokers offering XAUUSD provide these smaller lot sizes to enhance Gold's accessibility, allowing traders to begin with a minimum capital requirement as low as one hundred US dollars.

Mini lots are one-tenth of a standard gold contract. Micro lots are one-hundredth of a standard one.

Mini Lot Means 10 Ounces of Gold: Micro Lot is 1 Ounce

Mini XAUUSD lots opened spot gold trading to retail folks. They draw in more small investors. This helps explain why online XAUUSD grew so fast. Start with just $100.

Explore Additional Lessons & Topics:

- What's a Good XAU USD Leverage Ratio for Beginners?

- Trade AS 51 Indices: Use MT4 and MT5 Platforms

- List of Strategy Approaches and Methods for DAX Trading Decisions

- Step-by-Step Guide to Set Up and Open XAUUSD Trades in MT4

- What Time Does Gold Market Open & What Time Does Gold Market Close Sessions?

- Dow Jones 30 MetaTrader 4 Dow Jones Name on MT4 Platform

- What are Chande QStick Buy & Sell Signals?

- What are Alligator Buy and Sell Forex Signals?