Reversal Crypto Candlestick Setups - Inverted Hammer Bullish Candlestick Patterns Setups

Bullish and Bearish Reversal Candles for BTCUSD Trading

Reversal candlestick setups follow extended prior market trends. For a pattern to qualify as a reversal setup, an evident preceding trend must be present.

These reversal bitcoin crypto candlesticks patterns are:

- Hammer Candles Pattern and Hanging Man Bitcoin Candlesticks Pattern

- Inverted Hammer Candles Pattern and Shooting Star Bitcoin Candlesticks Pattern

- Piercing Line Candlesticks Pattern and Dark Cloud Cover Bitcoin Candlesticks Pattern

- Morning Star Crypto Candles and Evening Star Crypto Candles

- Engulfing BTCUSD Crypto Candles Patterns

Hammer and Hanging Man Patterns in Crypto Candles

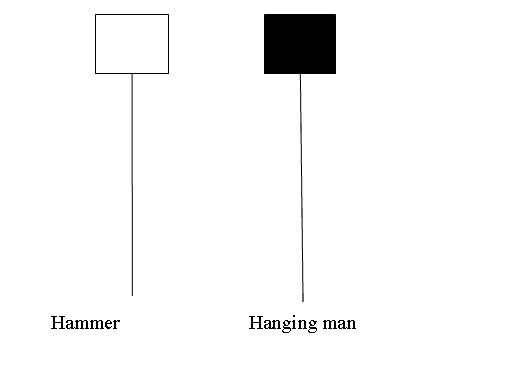

Hammer Candlestick Pattern and Hanging Man Bitcoin Candlestick Pattern bitcoin candles look similar but hammer is a bullish reversal bitcoin candles pattern & hanging man is a bearish market reversal bitcoin candlesticks pattern.

Analysis of the Hammer Candlestick Pattern and the Hanging Man Formation in BTCUSD Market Contexts

Hammer BTCUSD Candles Patterns

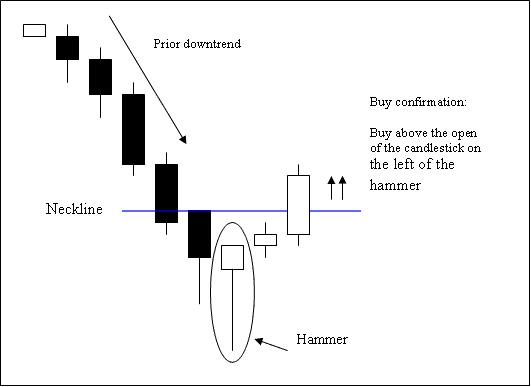

The hammer is a bullish pattern that appears in a downtrend for bitcoin. It looks like the market is hitting a bottom.

A hammer has:

- A small body

- The body is at the top

- The lower shadow is two or three times length of real body.

- Has no upper shadow or has a very small upper shadow if present.

- The color of the body isn't important

Hammer Crypto Candles

Bitcoin Analysis of Hammer Bitcoin Candlesticks Patterns

A buy cryptocurrency signal is confirmed when the price of the crypto candle closes above the opening price of the candle immediately to the left of the formed hammer cryptocurrency candle pattern.

Stop orders should be place a few pips just below the low of the hammer candlestick.

Reversal Candlestick Patterns: Bullish Crypto Setups and Bearish BTCUSD Patterns

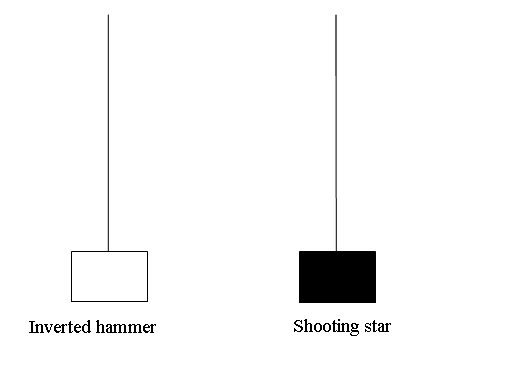

Inverted Hammer Candlesticks Pattern and Shooting Star Candlestick look similar in their formation. These candlesticks have a long upper shadow and a short body at the bottom. Their fill color does not matter. What matters is the point at where they appear whether at the top of a market btcusd crypto trend (star) or the bottom of a market bitcoin trend (hammer).

The difference is that an inverted hammer is a sign of a coming price increase, while a shooting star is a sign of a coming price decrease in trading formations.

Upward BTC/USD CryptoCurrency Trend Reversal - Shooting Star Candles

Downward BTC/USD CryptoCurrency Trend Reversal - Inverted Hammer Candlesticks

Inverted Hammer and Shooting Star Candlestick Patterns for Bitcoin - Cryptocurrency Candlestick Setup Configurations

Inverted Hammer Crypto Candle

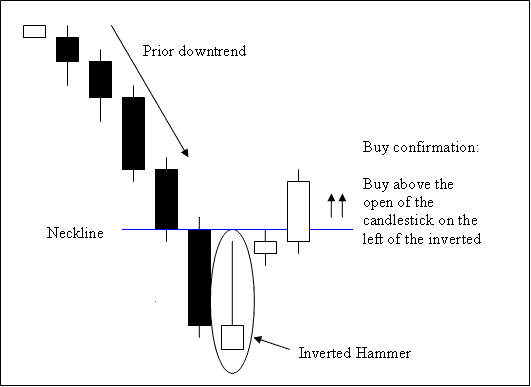

This configuration represents a bullish candlestick pattern signaling a market reversal, occurring at the base of a Crypto trend.

The Inverted Hammer pattern manifests at the lower boundary of a declining bitcoin trend, suggesting a potential reversal to an upward movement.

Inverted Hammer Crypto Candle

Bitcoin Analysis of Inverted Hammer Crypto Candlestick

A buy confirmation is established when a cryptocurrency candlestick closes above the neckline: this neckline corresponds to the opening of the cryptocurrency candlestick situated to the left of the pattern. In this context, the neckline functions as a resistance zone.

Stop orders to buy should be placed a few pips under the lowest recent bitcoin cryptocurrency price that has been observed recently.

Inverted hammer is named so because it shows that the btcusd market is hammering out a market bottom.

Obtain Further Programs & Instructional Material:

- BTC USD Strategy for Beginner Traders

- MACD Classic Divergence BTC USD Strategies

- No Deposit Bonus No Deposit Bonus BTC USD Account

- How Do I Analyze a Trading Candles Patterns Signals?

- Learn Tutorial Course for Beginners Online Learn Trading Training Training Course

- How Do You Set Stop Loss BTC USD Order & Take Profit BTC USD Order on MetaTrader 4 Software/Platform?

- BTC USD Set Take Profit BTC USD Order on MT5 Android App

- How Much Capital Does it Cost to Open a Mini BTCUSD Trade Account?

- Account MT4 Trade Platform Trading Account Login

- Metaquotes Platform/Software MT5 Opening BTC/USD MT5 Open BTC/USD Charts