Bitcoin Indicators for Setting Stop-loss in Bitcoin Trading

Some crypto indicators help you set stop losses automatically, so you don't have to stress over complicated calculations for your bitcoin trades.

A trader employing bitcoin systems can also set stop-loss orders based on signals derived from technical cryptocurrency indicators. Certain indicators employ mathematical algorithms specifically designed to calculate the optimal placement for a protective stop-loss cryptocurrency order, ensuring an effective exit point. These indicators serve as the foundation for setting stop-loss cryptocurrency orders, as they closely track the price action of the bitcoin instrument and define the acceptable price boundaries. If the bitcoin price breaches these defined limits, it suggests a shift away from the established direction, making it prudent to liquidate any open cryptocurrency positions.

Step 1: On the MT4 index of technical indicators, select the 'Volumes' button key, precisely as demonstrated and illustrated underneath:

How do you use automatic stop loss and take profit indicators for BTCUSD?

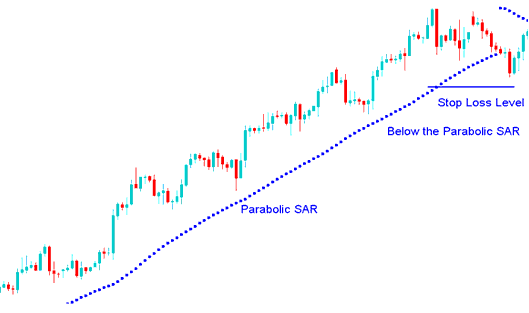

Parabolic SAR is like an Automatic Stop Loss Bitcoin Order & TP Bitcoin Order Indicator used to set a trailing bitcoin price stop loss

The Parabolic SAR provides excellent exit points.

During a bitcoin upward trend, consider closing your long trades if the price dips below the Parabolic SAR indicator, as this signals a potential trend reversal.

During a declining trend for btcusd, any short positions should be closed if the bitcoin price climbs above the Parabolic SAR indicator.

If you are long then the bitcoin price is above the parabolic SAR, the SAR trading tool will rise each day, no matter which way the btcusd crypto price is moving. How much the Parabolic SAR rises relies on how much bitcoin prices move.

Parabolic SAR - Indicator - Automatic Stop Loss Bitcoin Order & TP Bitcoin Order Indicator

Picture of parabolic SAR and how it's used

Crypto Indicator for Setting Stop Loss Orders

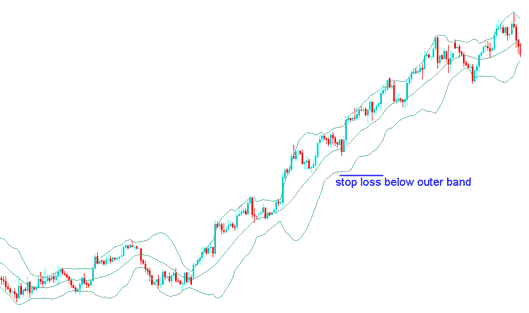

The Bollinger Band indicator employs standard deviations as its mechanism for gauging market volatility. Due to the fact that standard deviations inherently measure price dispersion, the Bollinger Bands are dynamic: they expand during increments of elevated market volatility and contract when market price volatility lessens.

Bollinger Band cryptocurrency indicator has 3 bands made to cover most of an instrument's bitcoin price changes. The middle band is the base for the bitcoin trend over time: usually, it's a 20-day simple MA, which also helps calculate the upper and lower bands. How far the upper and lower bands are from the middle band depends on how much the price changes.

The Bollinger Bands, used to track the movement of the btcusd price, can also aid in placing stop-loss orders beyond the band levels.

Setting Stop Loss Bitcoin Order Levels Using Bollinger Bands - The Bollinger Bands Bitcoin Technical Indicator

How do you set up automatic stop loss and take profit for Bitcoin trades?

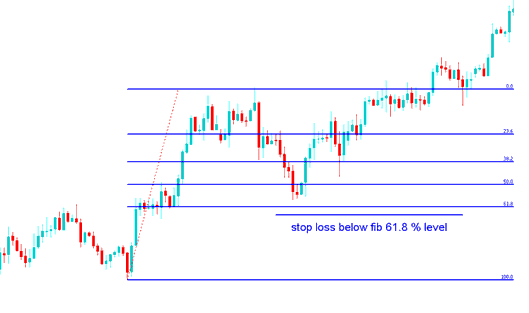

Fib retracement levels provide demarcated zones of support and resistance, which are then useful for setting stoploss order placements.

Level 61 of the Fib Retracement,. The most typical value for placing stop losses is 8%. Just below 61, a stop loss btcusd order should be placed. The 80% fib retracement level

Place orders at the 61.8% Fibonacci retracement level. It seldom gets reached exactly.

Fib Indicator Stop Loss Order Setting at 61.8% Retracement Level

Fibonacci retracement level 61.8% - Fib Indicator

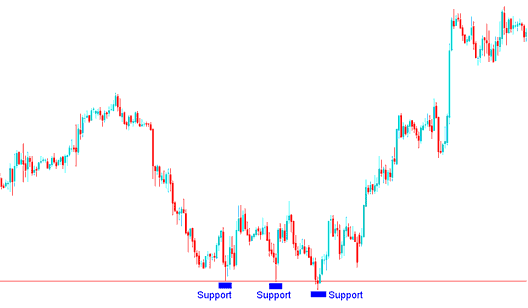

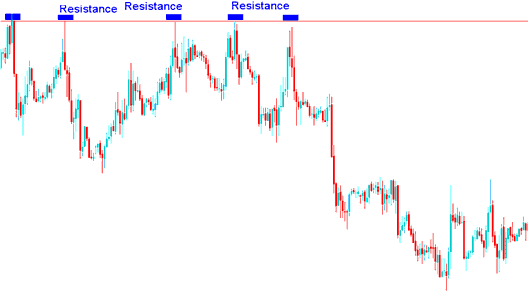

Support & Resistance Levels Lines

Traders use support and resistance levels to place stop loss orders. They set these crypto stops right above or below those key levels.

- Buy Bitcoin Trade - Stop-Loss Bitcoin Order set few pips below the support

Buy BTCUSD - Place Stop-Loss on Bitcoin Just Below Support

- Sell Bitcoin Trade - Stop-Loss Bitcoin Order set a few pips above the resistance

Sell BTCUSD with Stop-Loss Just Above Resistance Level

Study More Courses & Tutorials:

- Techniques for Trading Bitcoin Price Action Across Various Available Chart Time frames

- Adding the Market Facilitation Index Indicator to the Trading Chart

- How Can You Figure Out/Read a BTC USD Divergence Setup?

- How Can You Open Live BTCUSD Trade Account with $500?

- Ways to Look At/Understand BTC USD Trendline Signals

- How Can You Set Buy Limit BTC USD Order in BTCUSD Software?