Stochastic Bitcoin Trading System

This guide combines Stochastics with other tools. But Stochastic Bitcoin System has a good ring.

The Stochastic technical tool can be used with other tools to create a system for trading. We will combine it with the following for our example:

- RSI

- MACD

- Moving Averages Crypto Indicator

Example 1: Bitcoin Stochastic System

Sell Bitcoin Trading Signal Generated using Stochastic System

From our btcusd system the sell signal is generated when:

- Both Moving Averages are heading downwards

- RSI is below 50

- Stochastic heading downward

- MACD heading downward below centerline

The sell crypto signal showed up when all of the bitcoin rules were followed. The signal to stop trading is made when a signal happens that says the market is going the other way i.e. When indicators change direction.

A significant advantage of employing this approach is the confirmation of trading signals through the incorporation of diverse bitcoin indicators, aiming to mitigate the frequency of false or whipsaw signals during execution.

- Stochastic - is a momentum oscillator bitcoin indicator

- RSI- is a momentum oscillator bitcoin indicator

- Moving Averages Indicator- is a bitcoin cryptocurrency trend following bitcoin indicator

- MACD- is a bitcoin crypto trend following bitcoin indicator

It helps to use more than one trading indicator. Combining signals is way better than relying on just one - indicators can reinforce each other and cut down on false signals.

A Bitcoin trend-following technical indicator assists a trader by revealing the broader market context, while integrating multiple momentum indicators produces superior and more dependable entry and exit points for Bitcoin trades.

The indicator combinations and the signals they give for Bitcoin trading help understand a lot of the btcusd market activity.

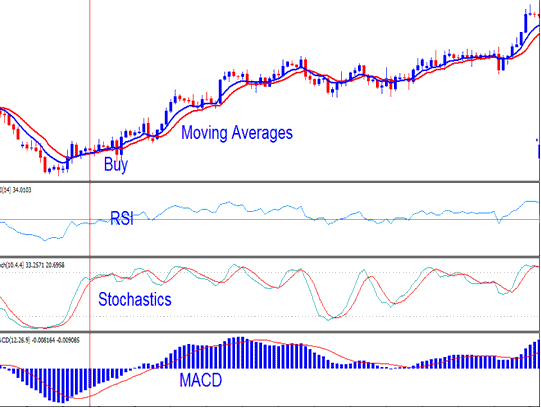

Example 2: Bitcoin Stochastic System

Buy Trade Signal Generated using Bitcoin Stochastic System

In this Bitcoin example, the trend points up clear. But the stochastic made some false whipsaws. Can you see them? The key is how to skip these crypto fakeouts.

Check other tools like the MACD crypto indicator to dodge a whipsaw. A BTC USD trader could spot it there. The MACD stayed near the zero line without crossing. The moving averages turned with a mild slope, not sharp enough for a clear crypto trend shift. Spotting whipsaws takes practice. It builds into a skill over time. Soon, you spot them from far off.

One tip is that as long as MACD cryptocurrency indicator is above zero center line even if the MACD lines are heading downward then the bitcoin crypto trend is still upwards. As you can see from the above example MACD cryptocurrency indicator never went below zero line and afterwards the upwards btcusd trend continued with MACD cryptocurrency technical indicator maintaining above Zeroline & continuing to move upwards.

In range-bound markets, the Stochastics Oscillator technical indicator generates the quickest Bitcoin trading signals, which may be vulnerable to whipsaws. For this reason, it's advisable to use the stochastic indicator in conjunction with other indicators to confirm the Bitcoin trading signals provided by one or two additional Bitcoin indicators.

Get More Tutorials:

- How Do You Add a Bitcoin Trade Trend Line on BTC USD Charts?

- Trade Fibo Pullback Strategies

- What Type of BTC USD Trade Style is Best for You?

- How Do I Analyze Chart Price Upward Trend?

- MT4 Demo Free BTC USD Practice Account

- BTC USD Market Execution BTC USD Order vs Pending BTC/USD Order

- Different Kinds of Bitcoin Trading Indicators That Are Oscillators

- Downwards BTCUSD Trend Line & Downwards Bitcoin Channel

- Daily Plans for BTC USD Using BTCUSD Trading Tools

- How Do You Setup Fibonacci Pullback Bitcoin Levels in MT4 Platform Software?