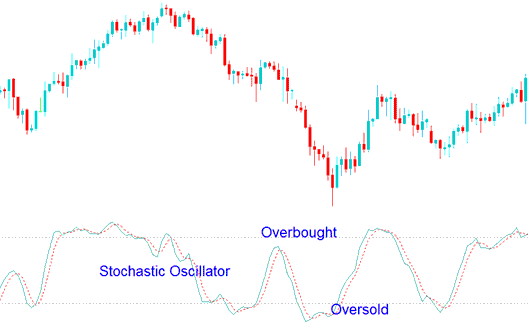

How Stochastic Oscillator Bitcoin Indicator Works

The Stochastic oscillator indicator uses periods of time to figure out the fast and slow lines. The amount of time used to figure out the %K and %D lines depends on why a btc/usd trader is using the Stochastic indicator.

- A trader using the Stochastic oscillator indicator in combination with a bitcoin trend indicator to see overbought and oversold levels, trader can use periods 10 periods.

- The default period used by stochastics bitcoin trading oscillator is 12.

Traders should not rely solely on the stochastic cryptocurrency indicator for making bitcoin trading decisions: instead, it should be used in conjunction with other technical indicators.

In sideways cryptocurrency markets, the Stochastic oscillator works well for spotting overbought or oversold levels. These spots can be good times to take profits or book some gains when you're trading BTCUSD.

The default oversold and overbought reference points for bitcoin trading are set at 20 and 80, though some traders opt for 30 and 70 instead.

To ascertain if the market is in an "overbought" state, the 80% mark on the stochastic bitcoin trading oscillator is utilized as a reference.

To identify the 'oversold' region, a 20% stochastic bitcoin trading oscillator mark is utilized.

The levels where the price is too high or too low are shown as dashed lines on the stochastic oscillator indicator. These levels can also be changed to the 30 and 70 marks.

Overbought & Oversold Levels in Stochastic Oscillator

Get More Tutorials:

- Exploring MA BTC/USD trend identification strategies specifically for Bitcoin trades.

- MT4 Trading Software Tutorial and Online Guide

- How Do You Analyze/Interpret a Trend Reversal Signal in Trading Chart Signals?

- Applying Trendline Signals to Trade BTC USD within Bitcoin Trading

- How to Read and Interpret BTC USD Trading Fib Extension Levels Strategies

- How to Analyze and Interpret a Bear Pennant Pattern

- Defining the Concept of a Channel within Bitcoin Trading Contexts

- How do I place a pending Bitcoin order in the MT5 iPhone trading application?

- How Do You Study/Understand Buy & Sell BTC USD Orders in MetaTrader 5 BTC USD Charts?

- Entry Stop Bitcoin Orders: Buy Stop BTCUSD Order and Sell Stop Bitcoin Order