Stochastic Momentum Index for Bitcoin - SMI Trading Signals

Developed & Created by William Blau.

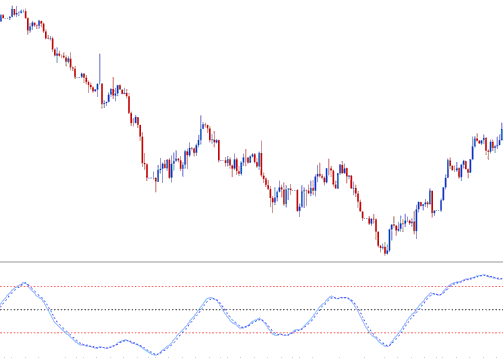

The Stochastic Momentum Index, or SMI, is like the regular Stochastic Oscillator, but it makes the stochastics changes smoother.

How do you build a Stochastic Momentum Index Indicator?

This btcusd tool is figured out by seeing how the bitcoin value is when compared to the typical mean over a set amount of time.

Instead of showing these values directly, a smoothing method called Exponential Moving Average is used, and then the values are drawn to make the SMI.

when the final bitcoin price is greater than the average of the range, the SMI will circulate up.

If the closing price of bitcoin falls beneath the average of its preceding range, the SMI value is set to decrease.

This particular oscillator operates within a boundary ranging from +100 down to -100, and it generally exhibits less susceptibility to false signals ("whipsaws") when contrasted with the stochastic oscillator trading indicator.

Bitcoin Crypto Currency Analysis & Generating Signals

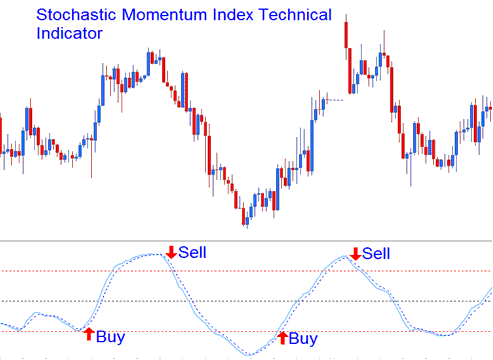

Buy and Sell Bitcoin Signals/ Crossover Signals

Use the Stochastic Momentum Index for crypto buy and sell cues. Buy as it rises. Sell when it drops.

Buy and Sell Bitcoin Signals/ Crossover Signals

Overbought/Oversold Level Bitcoin Crossovers

- Overbought levels above +40

- Oversold levels below -40

A buy signal occurs when this oscillator drops below the oversold threshold and subsequently rises above that level, starting to move upward.

A sell bitcoin signal appears when the oscillator tops the overbought line, then drops below and heads down.

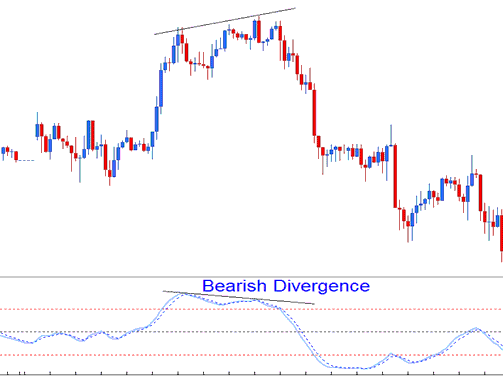

Divergence BTCUSD Trading

The example below shows a bearish classic divergence between Bitcoin price and the SMI. When the Stochastic Momentum Index displayed this split, the Bitcoin trend turned down and prices fell.

Bearish Bitcoin Trade Divergence

Learn More Tutorials & Topics: