Rate of Change: Bitcoin Signals

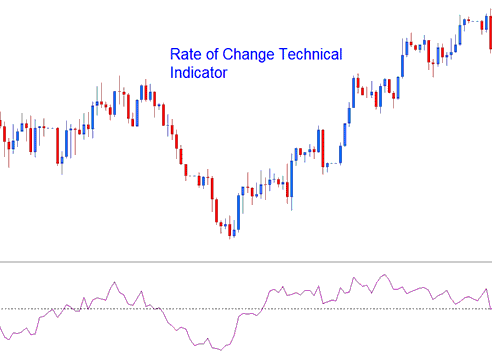

The Rate of Change indicator figures out how much bitcoin's price has changed over a set number of periods. It measures the difference between the current candle and the bitcoin price from earlier candles.

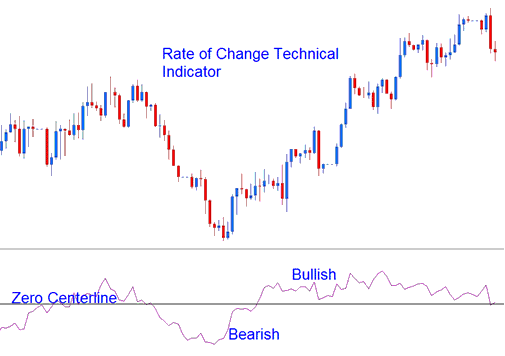

The difference can be worked out and shown as Points or Percentages. ROC usually goes up and down, moving above and below a center line at zero. Levels above zero show the price is likely to rise, while those below show it's likely to fall.

The larger the fluctuations in bitcoin prices, the more significant the changes in the Rate of Change (ROC).

BTCUSD Analysis and Generating Signals

Rate of Change indicator spots crypto signals in several ways. Common ones include:

BTCUSD Cross over Trade Signals

Bullish Signal - A buy cryptocurrency signal is triggered when the ROC crosses above the zero center line.

A signal indicating a potential downturn (Bearish Signal) for cryptocurrency trading arises when the Rate of Change value crosses beneath the horizontal zero center line.

Overbought/Over-sold Levels:

Overbought levels rise as bitcoin gets more overbought. Values above the overbought line mean bitcoin prices are too high. A correction may follow soon.

Overly sold: lower the reading, the more overbought Bitcoin is. Bitcoin is oversold, and a rise in the price of bitcoin is imminent, as evidenced by values that fall below the oversold threshold.

However, during strong trending markets the bitcoin price will remain in the Overbought/Oversold Levels for a long time, and rather than the bitcoin price reversing the bitcoin price trend will continue for quite some time. It is therefore best to use the crossover signals as the official buy & sell bitcoin signals.

Bitcoin TrendLine Breaks

Bitcoin Trendlines can be drawn on ROC trading indicator just the same way bitcoin trend lines can be drawn on btcusd price charts. Because The ROC is a leading technical indicator, the bitcoin trendlines on the indicator will be broken before those on the bitcoin price charts. A bitcoin trendline break on the Rate of Change is an indication of a bullish or bearish reversal bitcoin signal.

- Bearish reversal- Rate of Change readings breaking above a downward bitcoin trendline warns of a likely bullish reversal.

- Bearish reversal- Rate of Change values/readings breaking below an upward bitcoin trendline warns of a likely bearish reversal.

Divergence BTC USD Crypto Trading

The Rate of Change can be utilized to trade divergences and to pinpoint potential cryptocurrency signals indicating a reversal in Bitcoin trends. There are four distinct types of divergences: classic bullish, classic bearish, hidden bullish, and hidden bearish divergence.

Study More Lessons:

- How Can You Utilize a Buy Stop Order in the MetaTrader 5 Platform?

- How to Use Momentum BTC/USD Technical Indicator on Trading Chart

- Ways to Find a Symmetrical Triangle Shape When Trading Bitcoin

- How Much Does it Cost to Register a Nano BTCUSD Account?

- Stochastic BTC USD Trend Reversal BTC USD Strategies

- How Do I Read BTCUSD Setups and Japanese Candlesticks?

- Drawing BTCUSD Trendlines Using MetaTrader 4 Tools

- Indicator: Hull Moving Average for BTC/USD

- How can one analyze or interpret and log into the MetaTrader 4 platform?

- How does online Bitcoin trading work?