MACD Whipsaws and Fake Signals in Bitcoin Bull and Bear Markets

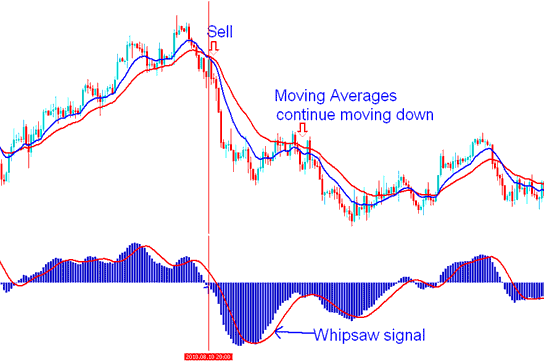

The MACD is a leading tool that can give false signals. Look at this bitcoin trade example of a whipsaw from MACD. It shows why waiting for confirmation helps in crypto trades.

MACD Bitcoin Indicator Whipsaw Fakeouts

The MACD indicator showed a signal to buy bitcoin, and this cryptocurrency signal appeared when the MACD technical indicator line was still below the zero center line. At this point, the buy cryptocurrency signal had not been confirmed, and it led to a bitcoin whipsaw, as shown by the MAs, which kept going down.

A bitcoin trading whipsaw signal occurs due to a rapid rise and fall in the BTC/USD price within a short timeframe, which distorts the data used to calculate the moving averages that inform the MACD cryptocurrency indicator. Such whipsaw fakeouts are often triggered by news events or announcements that generate market noise.

Traders need to be able to understand a bitcoin trading whipsaw and be ready for its quick turns: a bitcoin trading whipsaw could lead to a session where prices rise and then fall. To lower the risk from whipsaws, it is smart to wait to be sure of btcusd signals by watching for MACD to go above or below the zero middle line.

Combining MACD Crossover with Centerline Crossover Techniques to Mitigate Bitcoin Whipsaws

Buy bitcoin signal - When lines cross, and bitcoin price quickly goes up, then crosses a center line, the signal to buy cryptocurrency is confirmed.

A confirmed sell signal for cryptocurrency trading occurs when a crossover event is immediately followed by a sharp downturn in the Bitcoin price, subsequently confirmed by a central line crossover.

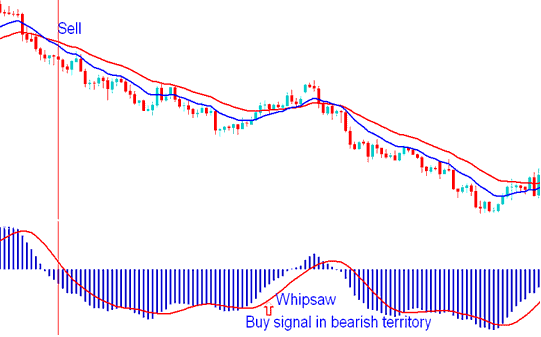

1. Buy Bitcoin Signal in Bearish Territory Whipsaw

When a buy signal pops up in bearish territory, it can lead to a bitcoin whipsaw - especially if a MACD center line cross-over doesn't follow soon after.

Take a look at the example below. The MACD cryptocurrency indicator flashes a buy signal even when things look bearish. Then, almost immediately, MACD turns south again, and you end up with a bitcoin whipsaw. Waiting for a center-line crossover helps you dodge that kind of whipsaw.

However, in this instance there was a brief centerline crossing: this bitcoin trading whipsaw would have been difficult to trade using MACD cryptocurrency indicator alone, that's why it is good to combine the use of MACD technical indicator with another trading indicator. In the example illustrated below MACD is combined with the moving average cryptocurrency indicators analysis.

MACD Crypto Whipsaw - Buy Signal in Bearish Territory

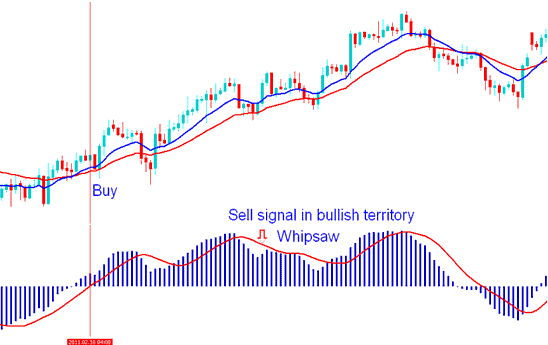

2. Sell Bitcoin Signal in Bullish Territory Whipsaw

When a signal to sell cryptocurrency shows up while prices are rising, it might cause a bitcoin fake-out, mainly if the MACD doesn't soon cross the middle line.

In the example below, the MACD crypto tool gives a sell signal in bull area. It then flips up, causing a false move. Wait for a center-line cross to skip that trap. Pair it with MA crossovers in the Bitcoin method, as shown. That avoids the false signal.

MACD Crypto Whipsaw - Sell Signal in Bullish Territory

To dodge bitcoin trading whipsaws with the MACD BTCUSD Indicator, stick to the Center Line Crossover Signal. Make that your official buy or sell signal - it's the most reliable one from the MACD Crypto Indicator.

Learn More Topics and Tutorials:

- How to subscribe to crypto instruments Forecast BTC USD Price on crypto instruments Chart?

- Types of BTC/USD Oscillator Indicators

- How to Trade Alligator BTC USD Tech Indicator in MetaTrader 4 Program

- Guide to Using Stop Loss Orders for BTC/USD in Apps

- Top 10 Indicators for Bitcoin

- How to use the Bears Power indicator in trading clearly described.

- How to understand and look at BTC USD trend-lines in MT5 BTC USD Charts

- Guide to Using Stop Loss Orders for BTC/USD in Apps

- How Do You Analyze/Interpret a Trend Reversal Trading Signal in Chart Trading Signals?

- The ADX Technical Indicator for BTC/USD Analysis