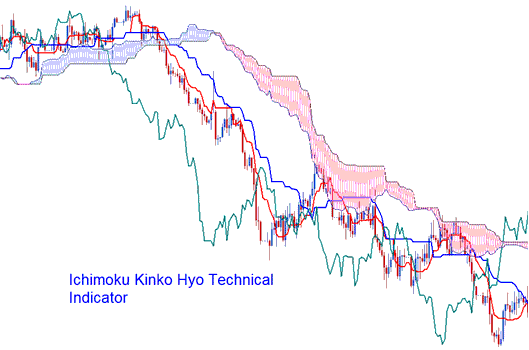

Ichimoku Kinko Hyo Indicator

Ichimoku is a Japanese charting methodology created by a writer, journalist, and editor for a Japanese newspaper, who operated under the pseudonym Ichimoku Sanjin.

- Ichimoku meaning: "a glance" or "a look"

- Kinko means "equilibrium" or "balance"

- Hyo is a Japanese term/word for "chart"

Ichimoku Kinko Hyo translates to "a glance at an equilibrium chart." This tool helps traders assess potential Bitcoin price movements and determine suitable times to enter or exit the BTC/USD market.

Calculation

This btcusd indicator has five lines that are drawn using the middle points of earlier highs and lows. The lines are figured out like this:

1) Tenkan Sen: This is the Conversion Line, represented by the Red Line, calculated as (Maximum High + Minimum Low) / 2, over the preceding 9 bitcoin price periods.

2) Kijun-Sen: Base Line: The Blue Line is calculated as (Highest High + Lowest Low) / 2 for the last 26 bitcoin price periods.

3) Chikou Span: Lagging Span: A Green Line shows where bitcoin closed 26 bitcoin periods ago.

4) Senkou Span A: Leading Span A = (Tenkan Sen + Kijun Sen) / 2, drawn 26 bitcoin price periods ahead

5) The Senkou Span B: Leading Span B: (Highest High + Lowest Low) / 2, for the last 52 btcusd price periods, shown 26 btcusd cryptocurrency price periods in the future.

Kumo: Cloud: area between Senkou Span A & B

BTCUSD Analysis and How to Generate Signals

Bullish signal - Tenkan-Sen crosses the Kijun Sen from below.

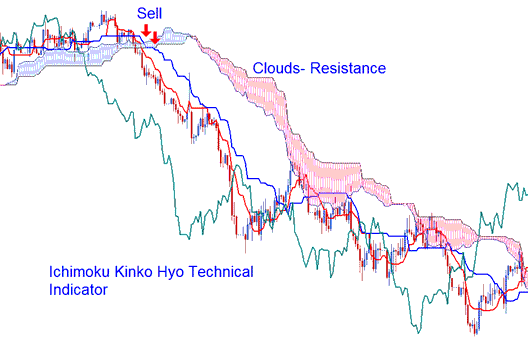

Bearish trading signal - Tenkan-Sen crosses the Kijun-Sen from above.

However, the strength associated with the buy signals and the sell signals generated for bitcoin displays variations across different zones.

Technical Analysis in Bitcoin Crypto Currency Trading

Bullish cross-over signal forms above Kumo (clouds),

Strong buy bitcoin signal.

Bearish cross-over signal forms below Kumo (clouds),

Strong sell bitcoin signal.

A bullish or bearish cross-over in the Kumo clouds gives a medium Bitcoin signal. It points to buy or sell.

A bullish crossover that happens below the clouds is seen as a weak sign to buy cryptocurrency, while a bearish crossover above the clouds is a weak sign to sell bitcoin.

Support & Resistance Levels

Support & resistance levels can be predicted by presence of Kumo (clouds). Kumo can also be used to identify the current bitcoin trend of the btcusd market.

- If bitcoin price is above the Kumo, the current market bitcoin trend is said to be upwards.

- If bitcoin price is below the Kumo, the current market bitcoin trend is said to be downwards.

The Chikou Span, also referred to as the Lagging Span, plays a role in assessing the conviction of buy or sell signals for Bitcoin.

- If the Chikou Span indicator is below the closing bitcoin price of the last 26 periods ago and a sell short signal is given, then the strength of the bitcoin trend is downward, otherwise the trading signal is considered to be a weak sell bitcoin signal.

- If there is a bullish signal and the Chikou Span is above the bitcoin price of the last 26 periods ago, then the strength of the bitcoin trend is to the up side, otherwise it's considered to be a weak buy bitcoin signal.

More Tutorials & Courses:

- Bitcoin Chart Objects in MetaTrader 4 - Navigating the BTCUSD Menu

- How Do You Set MT5 BTC USD Moving Average Oscillator for MetaTrader 5 BTC USD Platform?

- Automated BTC USD Trade Platforms & BTC USD Expert Advisors Software Platform Setup

- Procedure for Drawing a Fibonacci Extension on MT4 BTCUSD Charts

- Understanding and Interpreting the Double Tops Reversal Pattern

- BTC USD use MT4 Bitcoin Trading Software on iPhone

- MetaTrader 5 BTC USD program with support and resistance Bitcoin Indicator MT5 charts.

- Identifying When a BTC/USD Trend Is Coming to an End

- Trend Trigger Factor BTC USD Trend Trigger Factor BTC USD Technical Indicator

- How Do You Analyze/Interpret BTC USD Trendline Signals Analysis?