Analyze Double Bottoms Bitcoin Chart Setup

BTCUSD Trade Double Bottom BTCUSD Pattern

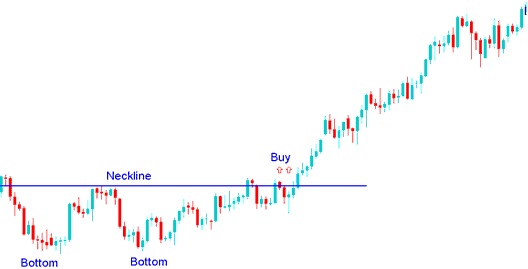

To understand how to use double bottoms, a btcusd trader must first learn about double bottoms pattern trading by looking at the analysis shown below.

How to Analyze Double Bottoms Bitcoin Pattern

Double bottom chart pattern is a reversal chart pattern that forms after an extended downward trend.

The double bottom chart pattern has 2 bitcoin price bottoms in a row that are about the same - with a peak that is not too high between the 2 bitcoin price bottoms.

A double bottom chart pattern is done when the bitcoin price makes a second low and goes above the highest price between the lows - this highest price between the lows is called the neckline.

A double bottom buy signal forms when bitcoin breaks up through the neckline.

In bitcoin trading, the double bottoms pattern serves as an early indication that a downward trend may soon reverse.

In the double bottoms chart pattern, the neckline is the resistance level for the bitcoin price: a double bottom chart pattern is only said to be confirmed when the neckline is breached. The price of bitcoin will increase once it breaks through this barrier.

Summary: Trading Bitcoin Interpret Double Bottoms Bitcoin Pattern?

- Double bottom chart pattern is formed after an extended bitcoin downward trend move

- Double bottom chart pattern signals that there'll be a reversal in the bitcoin trend

- Bitcoin traders will buy when the bitcoin price breaks out above the neck line: as explained on the double bottoms chart pattern example illustrated below.

Interpreting Double Bottom Formations in Crypto Trading - How to Read the Double Bottom Crypto Pattern Effectively

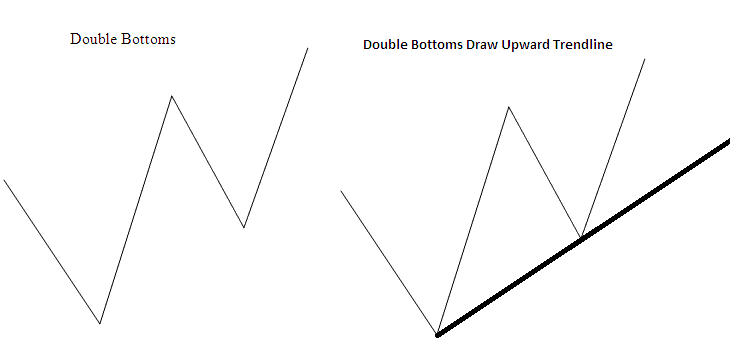

The double bottoms pattern resembles a W shape. An optimal double bottoms chart pattern for signaling a cryptocurrency reversal occurs when the second bottom price of Bitcoin is higher than the first, as demonstrated in the example below.

This shows that the reversal signal from the double bottom pattern in crypto can be confirmed by drawing an upward trend line for bitcoin, like in the example chart below. If you enter a buy trade for bitcoin, place the stop loss order just below this trend line.

Trading Interpret Double Bottoms Crypto Pattern

Interpret Double Bottoms Pattern

Review Further Programs and Directions:

- BTC USD Trade MetaTrader Demo Account Unlimited Time

- Fibonacci Retracement Strategies for BTC USD Utilizing Fibonacci Pullback Levels

- How Do I Draw Downwards BTCUSD Trend-Line in MT4 Platform Software?

- How Do I Draw Fib Pullback Levels in MT4 Bitcoin Charts?

- BTCUSD Trend Line Drawing Indicator

- What is Support Resistance BTC USD Trading Indicator on MetaTrader 4 Bitcoin Charts?

- MetaTrader 4 BTCUSD Trade Real Account Sign In

- How do Chaos Fractals work as a BTC/USD indicator on Bitcoin charts?

- How Do I Interpret Stochastic Technical Indicator on Chart?

- How Do I Use Fibo Pullback Levels for Day Trading Bitcoin?