Divergence Software

When trading divergence, you can get hints about Bitcoin when using a tool that shows how much things are changing.

Divergence signals that a current upward move (rally) or a downward correction (retracement) is losing momentum and an imminent reversal should be expected. This occurs when the most recent buyers or sellers are momentarily pushing the Bitcoin price in one direction, while the wider body of other traders has ceased participating in that direction and are adopting a more cautious stance regarding a potential BTCUSD price correction or decline.

There are four different types of divergence setups.

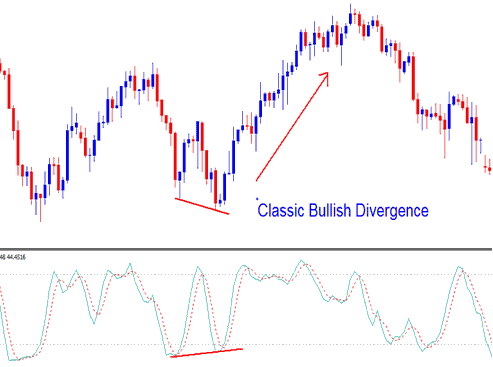

Example 1: Bitcoin Classic Bullish Divergence

A Bullish Divergence observed between the stochastic indicator and the bitcoin crypto price generally precedes a rise in btcusd price.

Divergence Detection Tool - Identifying Bullish Divergence on BTCUSD Cryptocurrency using Specialized BTCUSD Software

When bitcoin price makes new lows but the Stochastic doesn't drop below its prior low, the downtrend nears a turn. A bullish rally may follow.

In the example above, price hit a new low. But the stochastic did not match it. When BTCUSD dropped, the indicator should have too. Since it didn't, that's divergence.

This setup is even more reliable since it combines a difference in movement and then a rise past the 20% mark. This brings together the Overbought and Over-sold areas.

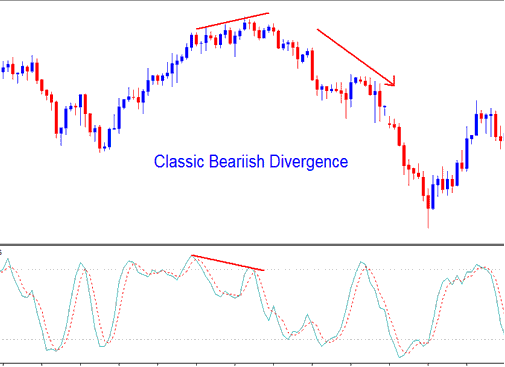

Example 2: BTCUSD Classic Bearish Divergence

A bearish divergence observed in the stochastic indicator, coinciding with the btcusd price movement, historically precedes a decline in the btcusd valuation.

Bearish Divergence Tool for BTCUSD Crypto on Bitcoin Platform

When the price of bitcoin reaches new high points, but the Stochastic tool does not reach its own previous high point, this could mean the bitcoin trend will change, and the price might go down.

This trade setup is deemed even more robust, as it combines a divergence setup with a decline below the overbought level of 80.

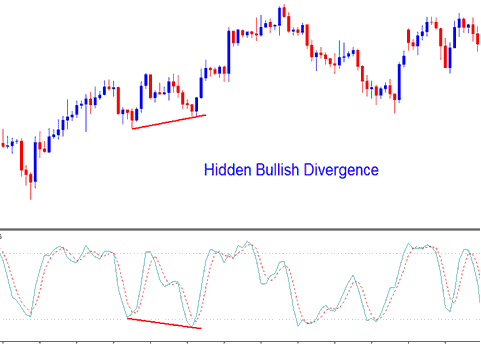

Example 3: Bitcoin Hidden Bullish Divergence

This pattern shows a pullback in an uptrend. It's the top divergence type for trades. You trade along with the Bitcoin trend, not against it.

Platform for Divergence Trading - Demonstrating Bullish Divergence in Bitcoin Using Specialized Bitcoin Software

Even though the stochastic oscillator went lower, the lowest bitcoin price was higher than the low before (a higher low, or HL). This means that even though sellers tried to lower the bitcoin price, as the stochastic shows, the bitcoin price didn't show this, and didn't hit a new low. It's best to buy bitcoin here because it's already going up. You don't have to wait for a signal since you're buying when Bitcoin is already trending upwards.

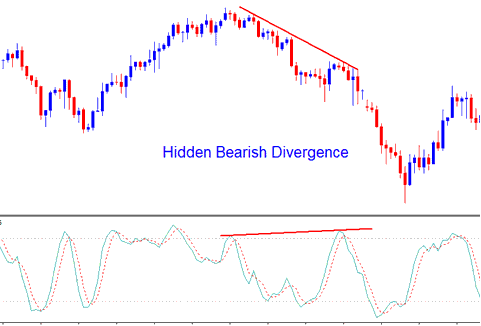

Example 4: BTCUSD Hidden Bearish Divergence

This setup signifies a retracement in a downwards trend.

Divergence Analysis Software - Implementing Bearish Divergence Detection for BTCUSD Using BTCUSD Cryptocurrency Software.

This is the best type of divergence to trade, because you're not trading a bitcoin price reversal, but you're trading within the direction of the trend. This is the best place to sell btcusd crypto, since it is even in a down bitcoin trend there is no need for you to chill and wait for a confirmation signal, because you are selling in a downward Bitcoin trend.

More Topics & Courses:

- How Do I Understand BTCUSD Patterns and Candlesticks?

- Where to Find a BTC USD Trading Strategies Training Guide Website

- What is the Way to Set a Expert Advisor Bot Online?

- Moving Average BTC/USD Tool for Day-to-Day Trade

- Clarifying the Distinctions Between Support Levels and Resistance Levels

- List of Bitcoin Indicators Collection BTCUSD Guides

- Methods for Interpreting and Analyzing Candlestick Formations in BTCUSD Trading Strategies

- How to Choose and Select a Bitcoin Trading Moving Average to Trade with BTC USD Strategies

- Set Take Profit and Stop Loss BTCUSD Orders on MT4

- How do beginners trade bitcoin successfully?