Bollinger Band

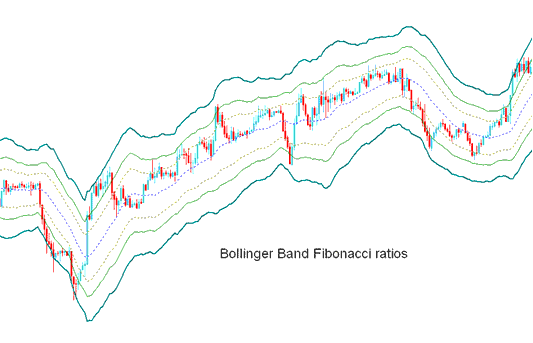

Derived from the original and initial Bollinger band.

The Bollinger Fibonacci ratios indicator tracks volatility, but it doesn't use standard deviation to set the channel width. Instead, it relies on a smoothed ATR, multiplying it by Fibonacci ratios like 1.618, 2.618, and 4.236.

These standardized lines, subsequently multiplied by the Fibo ratios, are then either added to or subtracted from the Moving Average (MA).

This forms 3 upper Fibonacci bands and Three lower Fibonacci bands

Middle band forms the basis of the trend.

BTCUSD Analysis and How to Generate Trading Signals

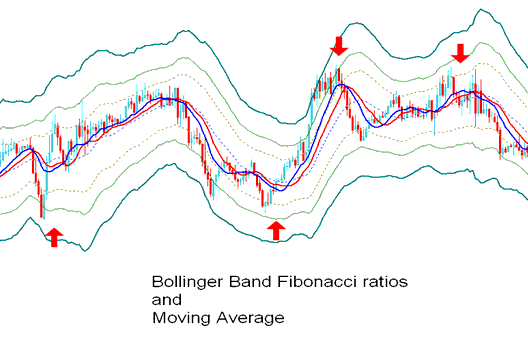

This specific BTCUSD indicator is employed to ascertain critical support and resistance boundaries for cryptocurrency movements.

The lines below represent support points while those above are resistance levels.

The outer-most bands provide the strongest support/resistance.

Inner most bands provide least support/resistance.

The innermost band represents Fibonacci 38.20% retracement level

The second band represents Fibonacci 50 % retracement level

The outermost band represents Fibonacci 61.80% retracement level

This tool spots spots where Bitcoin prices could turn around. (Bitcoin Pullback Zones)

When the bitcoin price reaches one of the lines and reverses, it generates an entry or exit trade signal.

Honestly, it's smart to back up your trading signal with other indicators, like the moving average (MA). That way, you get more confirmation - just like you see in the example below.

Technical Analysis in BTCUSD Crypto Trading

Learn More Topics & Courses:

- How do you trade BTC/USD with analysis strategies?

- Darvas Box – Breaking Down the Bitcoin Indicator

- Download BTC/USD Data for MT5 to Test Expert Advisors

- What is Different Between Buy Limit BTC USD Order & Buy Stop Bitcoin Order?

- Analyzing Chart Signals for Trend Reversal Signals

- How to Trade Using MT4 Trading Software

- A Complete Course Tutorial on Trading Using Trading Platform/Software

- How to Trade BTC/USD on MetaTrader 5 iPhone App

- How to Manually Draw a Trend Line on a Trading Platform Chart

- Download Link and Tutorial for the Ichimoku Kinco Hyo BTCUSD Indicator on the MT4 Bitcoin Trading Platform