MACD Index Hidden Bullish & Bearish Divergence

MACD Index Hidden divergence is used as a possible sign for a trend continuation.

This MACD Index Hidden divergence setup happens when the price goes back to test a high or low from before. The two MACD Index Hidden divergence setups are:

1. Hidden Bullish Divergence

2. Hidden Bearish Divergence

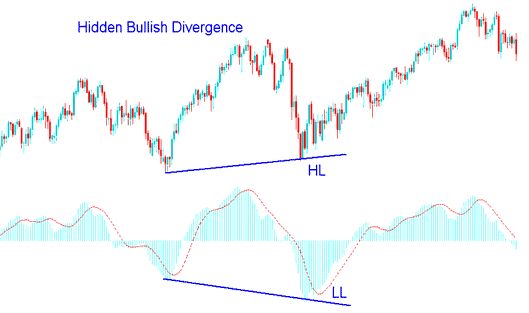

Hidden Bullish Divergence in Indices Trade

A hidden bullish divergence in the MACD shows up when price forms a higher low, but the MACD makes a lower low.

Hidden bullish divergence shows a pullback in a rising trend.

MACD Bullish Divergence Method - MACD Bullish Divergence Setup

This MACD bullish divergence in indices trading shows the pullback has ended. It points to strength in the upward trend.

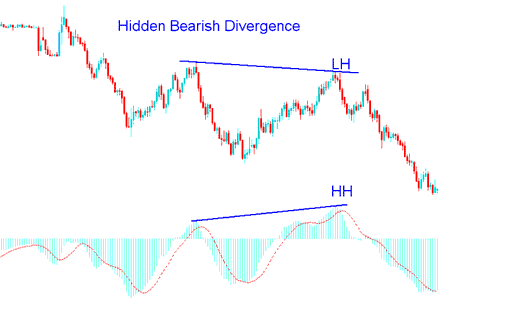

Hidden Bearish Divergence in Indices Trade

A MACD Hidden Bearish Divergence happens when price forms a lower high (LH), but the MACD oscillator shows a higher high (HH).

Hidden bearish divergence happens when prices go back up a bit in a trend that is going down.

MACD Bearish Divergence Method - MACD Bearish Divergence Setup

This MACD hidden bearish divergence shows a price pullback has ended. The pattern points to growing strength in the downtrend.

Note: Hidden divergence suits trading best. It signals in line with the trend. This offers strong entry points and beats regular divergence for accuracy.

Explore Additional Lessons, Tutorials, and Topics

- How to Work with MT4 Aroon Oscillator Tool on MT4?

- What Are the Benefits of MQL5 Signals for Traders Over Other Signals?

- How Should You Study FX Price Changes When Trading?

- NKY 225 Index Trading Strategy Example

- How to Use MetaTrader 5 Support & Resistance Indicator

- Forex Price Action 1-2-3 Strategy Price Break Out

- EURJPY Spread Described

- How Can You Set S&P ASX in MT4 S&P ASX?

- How Can I Draw Fibonacci Retracement Levels in the MT4 Trading Platform?

- How to Place AEX 25 on MT4 PC