Long-Term Index Trading Strategy

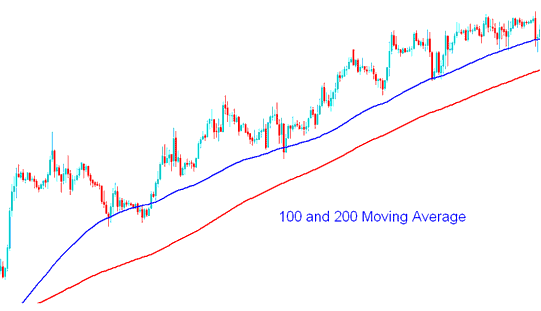

Long-term index strategies rely on 100 and 200 MAs. These serve as support and resistance. Many traders watch them, so prices often bounce off these levels.

100 and 200 MAs - Strategy Examples

In stock indices, traders use both fundamental and technical analysis to decide if a price trend is a good buy or sell.

In indices technical analysis, traders use the 200-day moving average to get a sense of supply and demand on the chart. It lets them look at the data from different angles.

Traders know the 200-day moving average well for indices. It marks long-term support or resistance. Price above it means a bull trend. Below signals bearish.

One method for gauging supply and demand in Stock Indices trading involves calculating the mean closing price over the last 200 trading sessions. This calculation incorporates each preceding day and illustrates the evolution of this 200-day average.

The average 200 day MA(Moving Average) is very common in Stock Indices technical analysis because it has historically been used to trade in the exchange market with good results. A common Indices strategy is to buy when the Indices market is above its 200 day moving average and sell when it goes below it.

This moving average tool for Indices sends alerts. It flags when price crosses the 200-day MA up or down. Pair it with basic analysis to pick long or short trades.

Find Additional Classes and Courses:

- Index Analysis for Beginner Index Traders

- FTSE100 System

- What are Trend Trigger Factor Buy and Sell Forex Signals?

- A Closer Look at MT4 Charting Software

- XAU/USD Introduction

- How to Place RVI Indicator on MT4 FX Chart

- FX Trade Balance of Power BOP EA Setup

- Choppiness Index MT4 Technical Indicator on Trading Charts