RSI Technical Analysis & RSI Signals

The RSI was developed by J. Welles Wilder.

The RSI is a very popular oscillator and useful momentum oscillator. RSI compares a Forex currency magnitude of recent gains against its magnitude of recent losses & quantifies this information into a value that ranges between 0 & 100.

Explanation

There are several popular techniques of interpreting, some of which include:

RSI Trade Divergence:

Looking for divergences between the RSI & price can prove to be very effective in identifying potential reversal points in price movement. Trade long on Classic Bullish Divergence: Lower lows in price and higher lows in the RSI; Trade short on Classic Bearish Divergence: Higher highs in price and lower highs in the RSI. These types of divergence are often indications of an impending reversal.

RSI Overbought Oversold Levels:

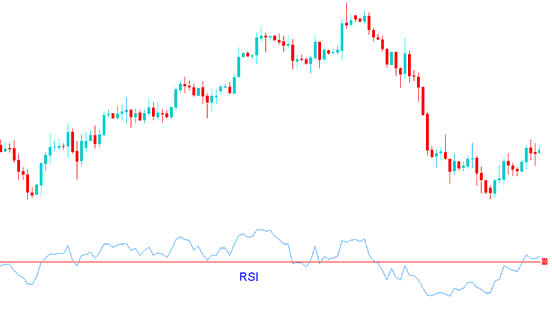

The RSI can be used to identify potential overbought and oversold conditions in price movements. An Overbought condition is generally described as the RSI being greater than or equal to the 70% level while an oversold condition is generally described as the RSI being less than or equal to the 30% level. Trades can be generated when the RSI crosses these levels. When the RSI crosses above 30 a buy signal is given. Alternatively, when the indicator crosses below 70 a sell signal is given.

RSI 50-level Cross over:

When the RSI crosses above 50 a buy signal is given. Alternatively, when the RSI crosses below 50 a sell signal is given.

RSI