Momentum MT4 Indicator Signals

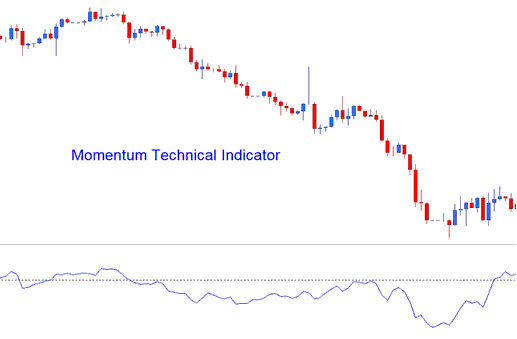

The momentum MT4 Indicator uses equations to calculate the line of plotting. Momentum measures the velocity with which price changes. This is calculated as a difference between the prevailing price candlestick and the average price of a chosen number of price bars ago.

Momentum represents the rate of change of the currency’s price over the particular time periods. The faster that prices rises, the larger the increase in momentum. The faster that prices decline, the larger the decrease in momentum.

As the price movement starts to slowdown the momentum also will slowdown & return to a median level.

Momentum

MetaTrader 4 Indicator and How to Generate Trade Signals

This MT4 Indicator is used to generate technical buy & sell signals. The three most common methods of generating signals used in FX are:

Zero Center-Line Cross overs Trade Signals:

- A buy signal gets generated when Momentum crosses above zero

- A sell signal gets generated when Momentum crosses below zero

Overbought/Oversold Levels:

Momentum is used as an overbought/oversold MT4 Indicator, to identify potential overbought and oversold levels based on previous readings: the previous high or low of the momentum is used to determine the overbought and oversold levels.

- Readings above the overbought level mean the forex pair is overbought & a price correction is pending

- While readings below the oversold level the currency is oversold and a price rally is pending.

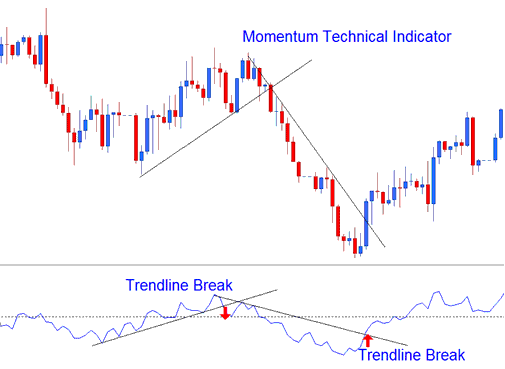

Forex Trend Line Breakouts:

Trend lines can be drawn on the Momentum MT4 Indicator connecting the peaks and troughs. Momentum begins to turn before price therefore making it a leading MT4 Indicator.

- Bullish reversal - Momentum readings breaking above a downwards trendline warns of a possible bullish reversal signal while

- Bearish reversal - momentum readings breaking below an upwards trendline warns of a possible bearish reversal signal.

Meta Trader 4 Indicator