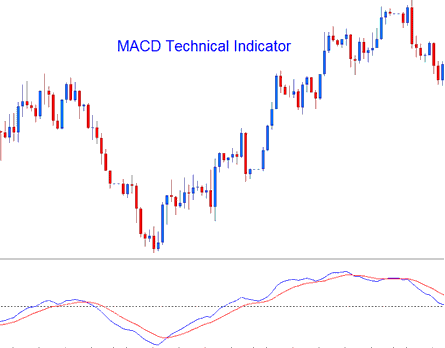

MACD Technical Analysis & MACD MT5 Indicator

Created by Gerald Appel,

The MA Convergence/Divergence is one of the simplest, reliable, and most commonly used indicators.

It is a momentum oscillator MT5 indicator MT5 indicator and also a trend-following indicator.

Construction

The construction of this MT5 indicator calculates the difference between two moving averages and then draws that as the 'Fast' line: the a second 'Signal' line is then calculated from the resulting 'Fast' line and then drawn on the same panel window as the 'Fast' line.

- 'Fast' line - Blue Line

- 'Signal' line - Red Line

The 'standard' MACD values for the 'Fast' line is a 12-period exponential moving average and a 26-period exponential moving average & a 9-period exponential moving applied to the fast line, this plots the 'Signal' line.

- Fast-line = difference between 12 and 26 exponential moving averages

- Signal Line = Moving Average of this difference of 9-periods

Forex Technical Analysis and Generating Signals

MACD is oftenly used as a trend-following indicator and works most effectively when interpreting trending market movements. 3 common techniques of using MACD to generate signals are:

Forex Crossovers Trading Signals:

Fast-line/Signal-line Cross over:

- A buy signal is generated when Fast Line crosses above Signal Line

- A sell signal is generated when FastLine crosses below Signal Line.

However, in a strong trending market this signal gives a lot of fake outs, the best cross-over to use would thus be the Zero Line Cross over Signal that is less prone to fake outs.

Zero Line Cross over Signals:

- When the Fast Line crosses above zero center line a buy signal is generated.

- when the FastLine crosses below zero center line a sell signal is generated.

Forex Divergence Trading:

Looking for divergences between the MACD & price can prove to be very effective in spotting the potential reversal and/or trend continuation points in price movement. There 2 types of divergences:

- Classic Divergence Signals

- Hidden Divergence Signals

Overbought/Oversold Conditions:

MACD is also used to spot potential overbought-oversold conditions in price action movements.

These levels are generated if the shorter MACD Lines separate dramatically from the median, this is an indication that price action is over-extending and it'll soon return to more realistic levels.

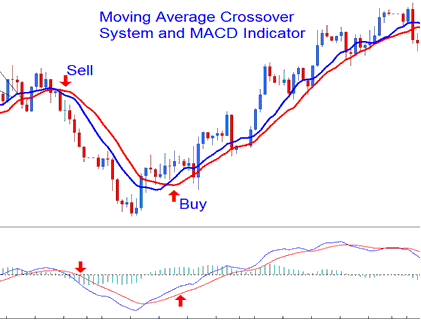

MACD & MA FX Crossover Strategy

This MT5 indicator can be combined with others to form a system. A good combination with the Moving Average cross-over system. A trade signal is generated when both give a signal in same direction.

Technical Analysis in Forex Trading