Setting Up MACD Expert Advisor - Moving Average Convergence/Divergence Expert Advisor Setup

Setting Up MACD Expert Advisor - Moving Average Convergence/Divergence Expert Advisor - A trader can come up with an MACD - Moving Average Convergence/Divergence Expert Advisor based on the MACD indicator explained below.

MACD - Moving Average Convergence/Divergence Expert Advisor rules can be combined with other technical indicators to come up with other EA Robots that trade using rules based on two or more indicators combined to form a trading system.

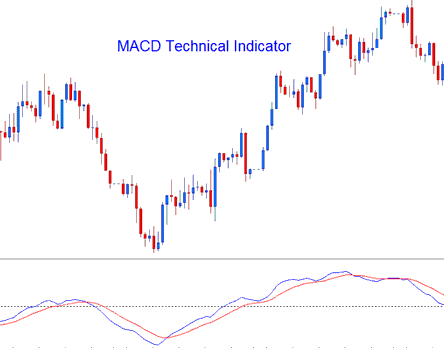

MACD - Moving Average Convergence/Divergence Analysis Signals

Developed by Gerald Appel,

The Moving Average Convergence/Divergence is one of the simplest, reliable, & most commonly used indicators.

It is a momentum oscillator and also a trend-following indicator.

Construction

The construction of this trading indicator calculates the difference between two moving averages & then plots that as the 'Fast' line: the a second 'Signal' line is then calculated from the resulting 'Fast' line and then drawn on the same window as the 'Fast' line.

- 'Fast' line - Blue Line

- 'Signal' line - Red Line

The 'standard' MACD values for the 'Fast' line is a 12-period exponential Moving Average & a 26-period exponential Moving Average & a 9-period exponential moving applied to the fast line, this plots 'Signal' line.

- Fast-line = difference between 12 and 26 exponential moving averages

- Signal Line = MA of this difference of 9-periods

Setting Up MACD Expert Advisor

Forex Analysis and How to Generate Signals

The MACD is oftenly used as a trend-following indicator & works most effectively when interpreting trending market movements. 3 common techniques of using MACD to generate signals are:

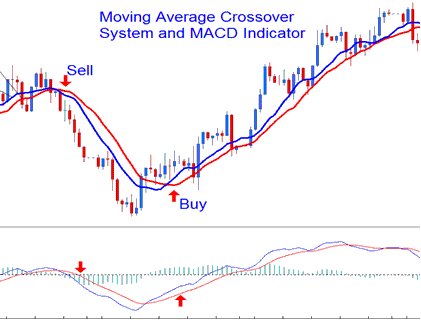

Forex Cross overs Trade Signals:

Fast-line/Signal-line Crossover:

- A buy signal is generated when Fast Line crosses above Signal Line

- A sell signal is generated when FastLine crosses below Signal Line.

However, in a strong trending market this signal gives a lot of whipsaw fakeouts, the best cross-over to use would thus be the Zero Line Crossover Signal that is less prone to whipsaw fakeouts.

Zero Line Crossover Signals:

- When the Fast Line crosses above zero center line a buy signal is generated.

- when the FastLine crosses below zero center line a sell signal is generated.

Divergence Trading:

Looking for divergences between the MACD & price can prove to be very effective in spotting the potential reversal and/or trend continuation points in price movement. There 2 types of divergences:

- Classic Divergence Signals

- Hidden Divergence Signals

Overbought/Oversold Conditions:

MACD indicator is also used to spot potential overbought-oversold conditions in price action movements.

These levels are generated if the shorter MACD Lines separate dramatically from the median, this is an indication that price action is over-extending & it will soon return to more realistic levels.

MACD & MA Cross over System

This indicator can be combined with others to form a trading system. A good combination with the Moving Average crossover system. A signal is generated when both give a signal in same direction.

Analysis - Setting Up MACD Expert Advisor