How Do I Use a Trendline in Forex Trading? - Trend Lines in Analysis

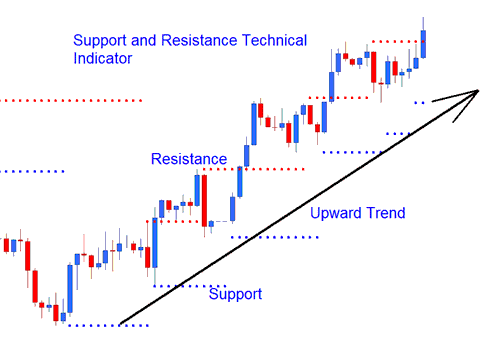

Trend lines in Forex Trading are used to illustrate the resistance or support levels of price as the price moves up-ward or downward as explained on the trend analysis examples below:

Resistance Levels & Support Levels when Upward Trend-Lines

Up-wards Trend Series of Support Levels and Resistance Levels - How Do You Use a Trendline in Forex Trading

Trend Analysis - Minor resistance and support levels of the price will quickly form a series of support levels & resistance zones in the short term & quickly move past these resistance & support points in an upward trend direction as shown on the up-ward trend example below.

Up-wards Trend: The up-ward trend pattern of this minor resistance and support points will form a series of support and resistance levels whose general trend direction is upward.

Up-wards Trend Series of Support and Resistance - How Do You Use a Trendline in Forex Trading?

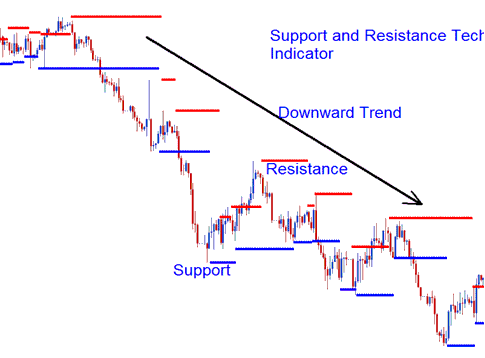

Support Levels and Resistance Levels when Downwards Trend-Lines

Downwards Trend Series of Support Levels and Resistance Levels - How Do You Use a Trendline in Forex Trading

Trend Analysis - Minor support & resistance zones of the price will quickly form a series of support levels & resistance zones in the short term & quickly move past these support & resistance zones in a downwards trend direction as pictured on the trend example below.

Downwards Trading Trend: The downward trend pattern of this minor support & resistance points will form a sequence of areas whose general trend direction is downwards.

Downwards Trend Series of Support and Resistance Levels - How Do You Use a Trendline in Forex Trading?