How Do You Trade Head & Shoulders Chart Pattern? - Head & Shoulders Pattern

How Do I Trade the Head & Shoulders Pattern - Head & Shoulders Pattern

Head & Shoulders Pattern

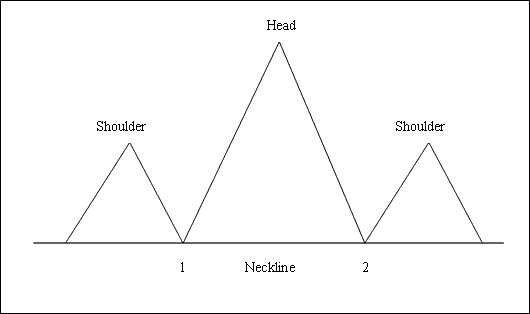

Head & Shoulders Pattern is a reversal chart pattern that forms after an extended upward trend.

Head & Shoulders Chart Pattern is made up of 3 consecutive peaks, left shoulder, head & right shoulder with two moderate troughs between the two shoulders.

This Head & Shoulders Chart Pattern is considered complete once price penetrates below the neckline, which is plotted by joining the two troughs between the shoulders.

To open a sell trade after this reversal signal, traders set their sell stop orders just below the neck line.

Summary:

- This Head & Shoulders Pattern forms after an extended move upwards - upwards trend

- This Head and Shoulders Chart Pattern formation indicates that there will be a reversal in the market

- This Head and Shoulders Chart Pattern formation looks like a head with shoulders thus its name.

- To plot the neck line we use chart point 1 & point 2 as shown on example below. We also extend this line in both directions.

- We sell when price breaks-out below neck-line: as described on the example below.

How Do I Trade Head & Shoulders Pattern? - Analysis of Head & Shoulders Chart Setup Patterns?

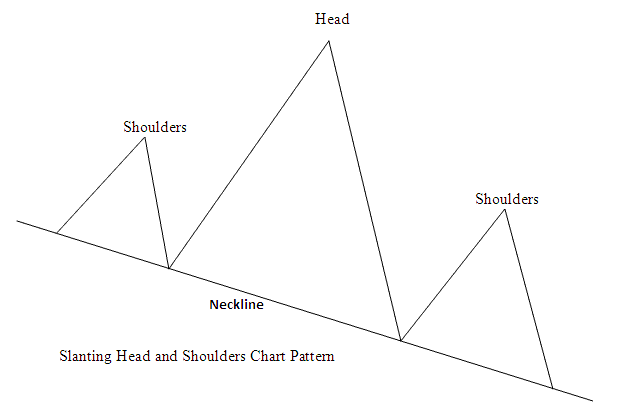

Or the head and shoulders chart pattern can also form on a slanting neck line, like the example below:

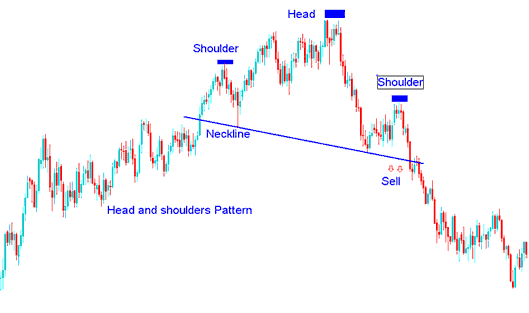

How Do You Trade Head & Shoulders Pattern? - Analysis of Head & Shoulders Chart Setup Patterns?

Example of Head & Shoulders Forex Pattern on a Chart

How Do I Trade the Head & Shoulders Pattern - How Do You Analyze Head & Shoulders Chart Setup Patterns?

This Head & Shoulders Pattern can also be formed on a slanting neck line, like the head & shoulders pattern example above, neck-line does not have to be necessarily horizontal.