How Do You Trade with Fibonacci Retracement Levels Indicator?

How Do You Trade with Fib Retracement Levels Indicator?

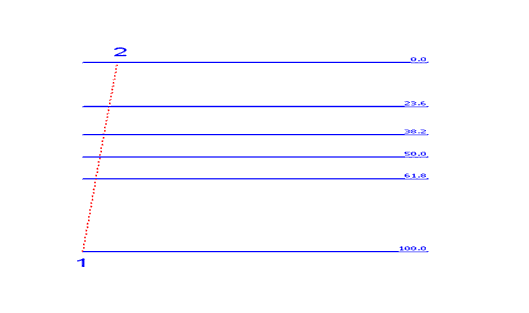

Fib Retracement Levels Indicator is a indicator used in forex trading to calculate price retracement levels in an upward trend or a downwards trend.

Fibonacci retracement levels are used by traders to open trades at better price after the price retraces and then resumes moving in the original trend direction after retracing.

What are the Fib Retracement Levels?

- 23.6 % Fibonacci Retracement Level

- 38.2% Fib Retracement Level

- 50.0% Fibonacci Retracement Level

- 61.8% Fib Retracement Level

38.2% & 50.0% Fibonacci Retracement Levels are the most commonly used Fibonacci retracement levels

most of the times this is where price retracement will reach - with 38.2% Fib Retracement Level being the most popular and most widely used price retracement level in forex trading.

61.8% Fib Retracement Level is also commonly used to set stop loss orders for trades opened using this Fib retracement levels strategy.

What's Fibonacci Retracement Levels Strategy using Fibo Retracement Levels?

How Do You Trade with Fibonacci Retracement Levels Indicator?

Fibonacci Retracement Strategies in Forex Trading

How Do I Trade with Fib Retracement Levels Indicator?

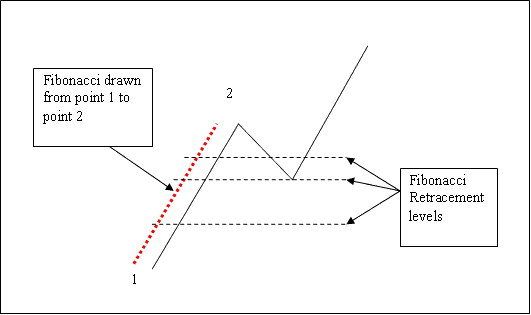

How Do You Draw Fib Retracement Areas on Charts?

Fib Retracement Levels trading tool is drawn in direction of the trend as shown in the two Fib retracement levels trading examples below:.

Fibonacci Retracement Levels Trading Strategy using Fib Retracement Levels

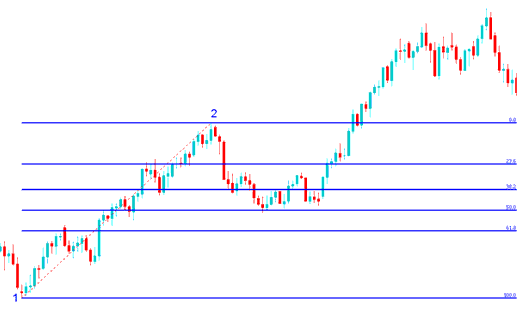

In the analysis example below the price is moving up between chart point 1 & chart point 2 then after chart point 2 - price retraces downwards to 50.0% Fib retracement level - then price continues moving up in original upwards trend. Note that this Fib retracement zones indicator is drawn from chart point 1 to chart point two in direction of the trend (Upwards Trend Direction).

How Do You Trade with Fibonacci Retracement Levels Indicator?

Fibonacci Retracement Strategy using Retracement Levels in an Upward Trend

Once the price hit the 50.0% Fib retracement level - this Fibonacci retracement zone provided a lot of support for the price - & afterwards the price then resumed the original upwards trend & continued to move upward.

For this Fibonacci retracement levels trading strategy example, the price retracement reached the 50.0 % Fibonacci retracement zone, but most of time the price will retrace up to 38.2% Fib retracement level and therefore most traders set their trading buy limit orders at the 38.2% Fib retracement level, while at the same time placing a stop loss order just below 61.8 % Fib retracement level.

Fibonacci Retracement Levels Trading Strategy using Fib Retracement Levels

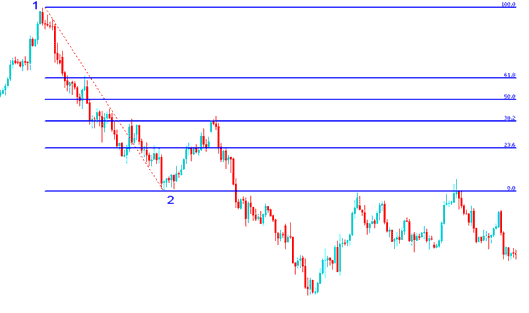

In the Fib retracement levels trading strategy example below the price is moving downwards between chart point 1 & chart point 2, then after chart point two the price then retraces up to 38.2 % Fibonacci retracement level then it continues moving downwards in the original downwards trend. Note that this Fib retracement zones indicator is drawn from chart point 1 to chart point two in direction of the trend (Downwards Trend Direction).

How Do You Trade with Fibonacci Retracement Levels Indicator?

Fib Retracement Levels Strategy in a Downward Trend

The above Fib retracement levels trading strategy example is a price retracement trading set up where the price retraces immediately after touching the 38.20% Fib Retracement Level.

In this Fibonacci retracement levels trading strategy example the retracement of the price reached 38.2% Fib retracement zone and did not get to 50.00% Fib retracement zone. It is always good to use 38.20% Fibonacci retracement zone because most times the price retracement does not always get to 50.00% Fibo retracement level.

This Fib Retracement zone provided a lot of resistance for the price pullback, this was the best place for a trader to place a trading sell limit order as the price quickly moved down after touching this Fib Retracement level - price pullback level.

How Do You Trade with Fibonacci Retracement Levels Indicator?