How Do You Analyze Price Action Strategy?

How Do You Trade Price Action Strategy?

Price action forex trading strategy is use of only price charts to trade FX, without the use of technical chart indicators.

When trading with this forex price action forex trading method, candle charts are used. This forex price action forex strategy uses lines & pre-determined price action patterns such as the 1-2-3 price action setup that either develops one forex price action setup or series of price action setups.

Traders use this forex price action forex setup strategy because this forex price action analysis is very objective & allows a trader to analyze the market forex price moves based on what they see on forex instrument price charts and market movement analysis alone.

Price action forex strategy is used by many traders: even those that use indicators also integrate some form of price action strategy in their overall forex strategy.

The best use of this forex price action technique is achieved when trading signals generated are combined with forex line studies to provide extra confirmation. These forex line studies include forex trend lines, Fibonacci retracement zones, support and resistance areas.

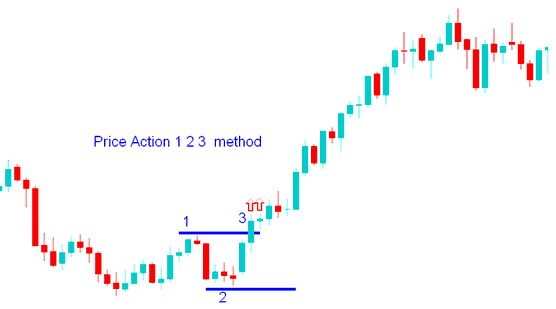

Price Action 1-2-3 Break out Pattern

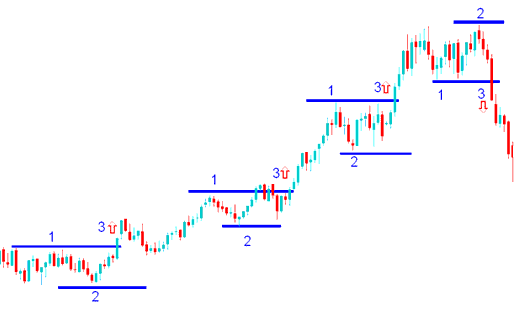

This forex price action forex strategy uses Three chart points to determine the breakout direction of a forex instrument forex price action.

The 1-2-3 price action forex technique uses a peak & a trough, these points forms point 1 and point 2, if market forex price goes above the peak the forex price action signal is long, if price action drops below the trough the forex price action forex signal is to sell. The forex price action breakout of point 1 or point two forms the third point.

What's Price Action Strategy?

Series of price action breakouts

What's Price Action 1.2.3 Strategy?

How Do I Analyze Price Action Strategy?