How Do You Analyze Price with Different Chart Time Frames?

How Do You Trade Price with Different Chart Time frames?

Example of Different Chart Timeframes

Traders using analysis use charts to try & attempt to predict the movement of price on the charts.

Traders will sometimes use 2 or more chart time frames so as to determine the long-term trend & the short term trend.

How Do You Define A Price Trend?

Using a system that has Three indicators - MA Cross over System, RSI and MACD & using simple rules to define the market trend. The rules are:

Upwards Trend

Both MAs Moving Up

RSI above 50 Level

MACD Above Center-Line

Down-wards Trend

Both Moving Averages Moving Down

RSI below 50 Level

MACD Below Center-Line

The traders using different chart timeframes will need to testout various chart time-frames so as to determine the best chart timeframe for them to trade.

Multiple charts time-frames analysis equals using 2 chart time-frames to trade instruments - a shorter one used for trading and a longer one to check the trend.

Since it is always good to follow the market trend, in Multiple Chart Timeframe Analysis, the longer chart timeframe gives us the direction of the long-term trend.

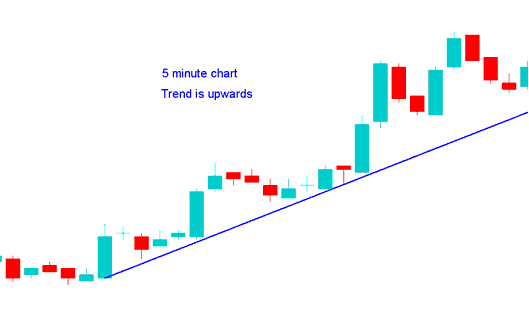

5 Minute Chart Timeframe

5 Minute Chart Timeframe

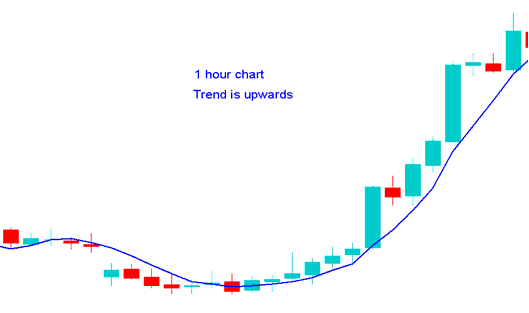

1 H Chart Timeframe

1 H Chart Timeframe

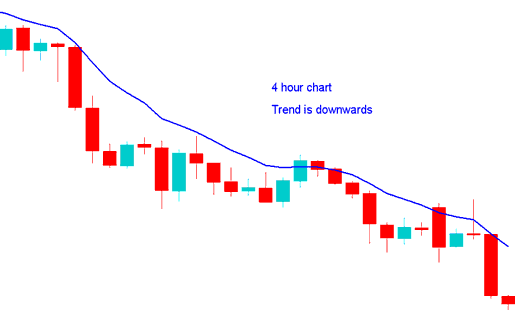

4 Hour Chart Timeframe

4 Hour Chart Timeframe

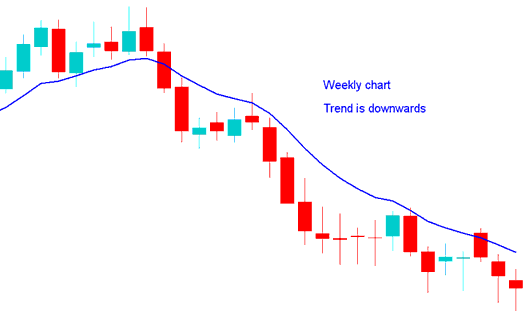

Weekly Chart Timeframe

Weekly Chart Timeframe

How Do I Analyze Price with Different Chart Time frames?