How Do You Calculate Forex Trading Trailing Stop Loss in Forex?

How Do You Calculate Forex Trading Trailing Stop Loss in Forex?

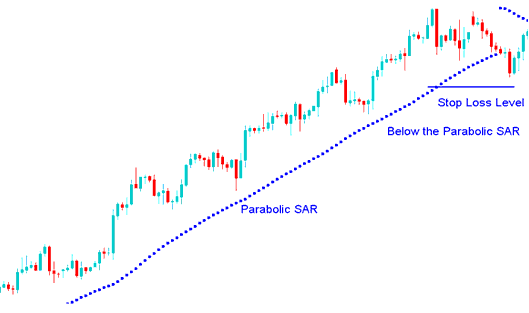

A trailing stop loss order setting level can be calculated using indicators such as the Parabolic SAR indicator.

If the market rises by a set number of pips the parabolic SAR indicator then adjusts the trailing stop loss level upward accordingly.

Also if the market falls by a set number of pips the parabolic SAR indicator then adjusts the trailing stop loss level downwards accordingly.

Parabolic SAR Indicator

Parabolic SAR is used by traders to set a trailing price stop loss levels

The Parabolic SAR technical indicator provides good exit points that keep trailing the price of a instrument.

In an upward trend, you as a trader should close buy trades when the price falls below the parabolic SAR

In a downwards trend, you should close short trade transactions when price rises above the parabolic SAR indicator.

Parabolic SAR

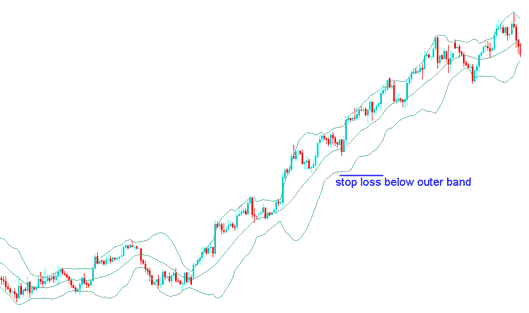

Bollinger Band Indicator

Bollinger Band trading indicator use standard deviation indicator as a measure of volatility. Since standard deviation is a measure of price volatility, the bands are self-adjusting meaning they widen during periods of higher price volatility & contract during periods of lower price volatility.

Bollinger Band consist of 3 Bollinger bands designed to encompass the majority of a trading instruments price action. The middle band is a basis for the intermediate-term trend, mostly it is a 20 day period simple MA, which also serves as the base for calculating the upper band and lower band. The upper band's and lower band's distance from the middle band is determined by price volatility.

Since these bollinger bands are used to encompass the instrument price action, the bands can be used to set stop losses just outside the area of the bollinger bands.

Bollinger Band Indicator

How Do You Calculate Trailing Stop Loss in Trading?