How Do You Place a Sell Limit Order?

How Do You Trade a Sell Limit Order?

A sell limit is an order used to sell instrument at better price after price has retraced upwards from its current level.

A sell limit pending order is an order to sell after the market retraces upwards within a downward trend.

A sell limit order is only executed when instrument prices moves upwards & retraces to the set sell limit pending order level.

Entry Limit Orders: Sell Limit

Sell Limit Order order definition - Entry sell limit order is an order to sell a instrument at a certain price which is a pull back area where price is predicted to pull-back to before it resumes the original trend.

Forex traders use sell limit orders to sell at better market price. These types of sell limit orders are available in most of online softwares, for our example we shall be using the MetaTrader 4 software platform.

An entry sell limit order of this type can be used to sell above market level (retracement pull back in a downwards trend market).

Sell limit - When selling, your entry sell limit order is executed when market rises to your set price. ( retraces upward )

Entry orders are set by traders when they expect price to pull back downwards after reaching this level.

- Entry Sell Limit Ordersell at a level above the current market level.

Sell Limit Order

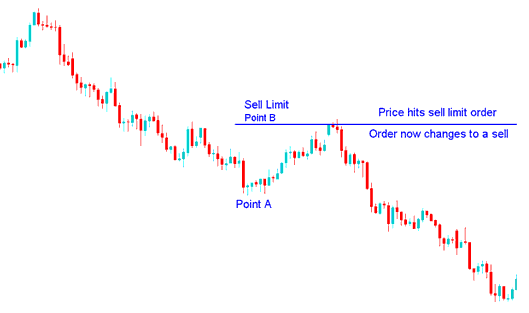

In the example below a the sell limit order was placed to sell at a price above the ruling market price. This is the level for the price pull back.

Sell Limit Order Placed to Sell above Current Price

The instrument then rallied, went upwards to hit sell entry limit order, & afterwards price continued to move downwards in direction of the original downward trend.

Forex Price Hits Sell Limit Order

When instrument price got to the set sell limit order level the sell limit order changed in to a sell order, this is therefore a good method to sell at better price after a pull back.

How Do You Place a Sell Limit Order?