How Do I Analyze Inverse Head & Shoulders Chart Pattern?

How Do You Read Inverse Head & Shoulders Chart Pattern?

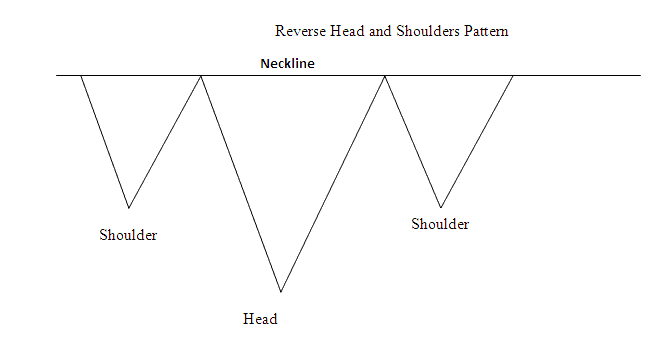

Inverse Head and Shoulders Pattern is a reversal pattern setup that is formed after an extended downward trend move. Inverse head and shoulders chart pattern resembles an upside down head & shoulders pattern setup.

Inverse Head and Shoulders Chart Pattern is considered complete once the price penetrates & moves above neck-line - the neck-line is drawn by joining the 2 price peaks that are between the inverse shoulders.

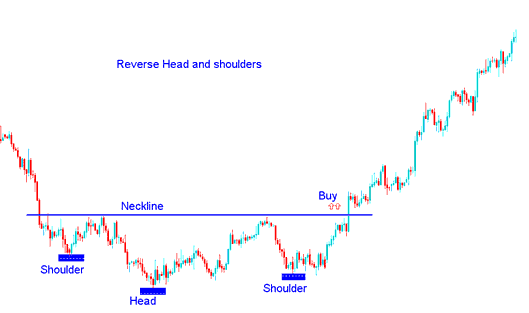

To open a buy trade - traders set their buy stop pending orders just above the neck line region.

Summary: How Do You Interpret Inverse Head and Shoulders Chart Pattern?

- Inverse Head and Shoulders Chart pattern setup forms after an extended downward trend move

- Inverse Head and Shoulders Chart Pattern signals that there'll be a reversal in the downward trend

- Inverse Head & Shoulders Chart Pattern formation resembles an up-side down head & shoulders pattern - thus its name - Inverse Head & Shoulders Pattern.

- Forex traders will buy when price breaks-out above neck line: as described on the inverse head and shoulders chart pattern example below.

How Do You Analyze Inverse Head and Shoulders Pattern?

Inverse Head & Shoulders Chart Pattern on a Chart

How Do I Read Inverse Head & Shoulders Chart Pattern?

How Do You Analyze Inverse Head and Shoulders Pattern?