How Do I Analyze Trend Line Setups used in Trend Trading Analysis?

How Do You Trade Trend Line Setups used in Trend Trade Analysis?

Forex Trend Line Bounce - Trend Line Setups

The trendline bounce setup is a continuation trading signal where the price bounces off the trend line and continues in the same direction as that of the trend.

Forex Trendline Bounce Trend Trading Forex

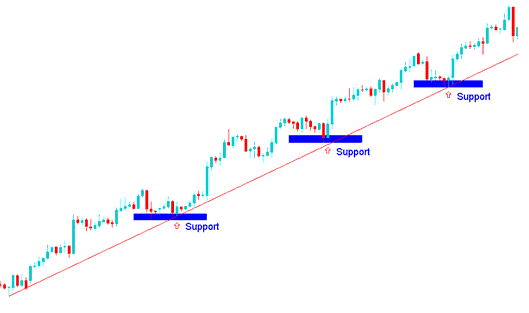

- In an upwards trend, the price will bounce upwards after hitting this upwards trendline level which is the support level.

Forex Upward Trend - Trend Line Bounce Setup after Touching The Support Areas Provided by the Upward Trend Line

Upward Trend Line Bounce Trend Line Setups

Forex Trend Line Bounce Trend Trading Forex

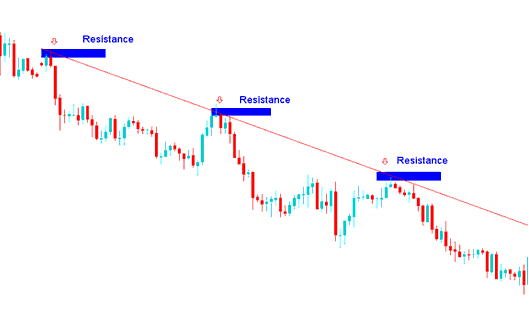

- In a downward trend, the market will bounce downwards after hitting this trendline level which is the resistance level.

Forex Down Trend - Trend Line Bounce Setup after Touching The Resistance Areas Provided by the Downwards Trend Line

Downward Trend Line Bounce Trend Line Setups

Example: Trend Line Break - Trend Line Patterns

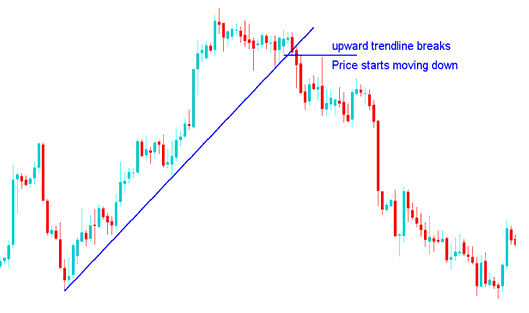

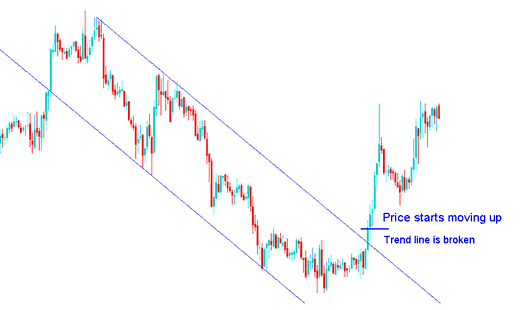

The trend line break setup is a reversal signal where the market moves through the trendline and starts moving in opposite market direction.

FX Trend Line Break Trend Trading Forex

When a up trendline setup is broken then the sentiment of the market trend direction reverses & becomes bearish

Upward Trend Line Break Trend Line Setups

Forex Trend-Line Break Trend Trading FX

When a down trend line pattern is broken then sentiment of the reverses and becomes bullish

Downward Trend Line Break Trend Line Setups

NB: for very strong trend patterns, after this trend line break reversal pattern, the price will consolidate for some time before moving in opposite trend direction. For short term trends then this trend line reversal pattern will mean price direction might reverse immediately.

How Do I Analyze Trend Line Setups used in Trend Trade Analysis?