Hanging Man Candle Setups - How to Analyze Hanging Man Bearish Candles Pattern

Hanging Man Candle Setup

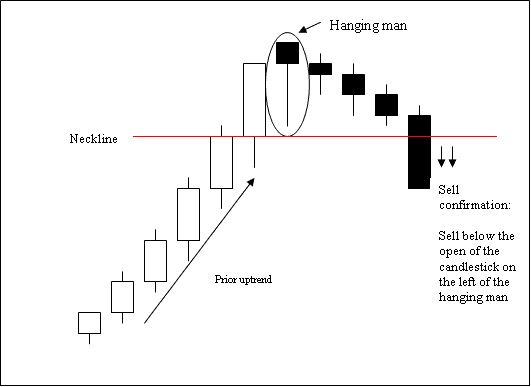

Hanging Man Candles Pattern is a potentially bearish reversal which happens during a uptrend. Hanging Man Candle Setup is named so because it resembles a man hanging on a noose up high.

A hanging man candle pattern has:

- A small body

- The body is at the top

- The lower shadow is 2 or 3 times the length of the real body.

- Has no upper shadow or very small upper shadow if present.

- The color of the body is not important

How to Trade Hanging Man Candles Patterns - How to Analyze Hanging Man Candles Pattern

Technical Analysis of Hanging Man Candles Patterns

Sell signal is confirmed when a bearish candlestick closes below the open of the candlestick on the left side of this hanging man candlestick setup.

Stop Loss orders should be set a few pips just above the high of the hanging man candlestick setup.