Forex Multiple Timeframe Strategy - Technical Analysis Using Multiple Timeframes

Multiple time-frame strategy equals using 2 chart time frames to trade forex - a shorter chart time-frame used for trading & a longer chart timeframe used to check the trend.

Since it is always good to follow the trend when forex trading, in Multiple Chart Time-Frame Analysis, the longer chart timeframe gives us the direction of the long-term trend.

If the long-term trend direction supports the direction of smaller chart timeframe then the probability of opening a profitable trade is significantly increased. This is because even if you make a mistake the long-term trend will eventually save you. Also if you trade with direction of the market trend, then mostly you'll be on winning side - this is what this Multiple Time-frame Analysis is all about.

Remember there a popular saying by many traders & investors that says: 'The trend is your best friend' - never go against the market trend when trading.

There are 4 different types of traders - all these different types of traders use different chart timeframes to trade as shown and illustrated below.

Examples of how each type of trader uses multiple timeframes strategy:

Forex Scalping - Multiple Timeframe Analysis Scalping

Scalpers hold onto their trades for only a few minutes. The scalping trader never holds on to a trade for more than ten minutes. With goal of earning small sums of pips as a profit, 5 pips - 15 pips.

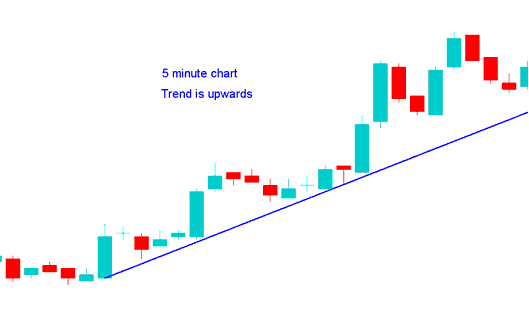

A Scalper using 1 min chart wants to open a buy trade, checks 5 min chart, which resembles the one below, since 5 min chart show trend is heading up, then decides from this multiple time-frame strategy its okay to open a buy trade.

Technical Analysis Using Multiple Timeframes - Forex Multiple Timeframe Trading Strategy

Day Traders - Multiple Timeframe Analysis Day Trading

Day traders hold onto their open trades for few hours but not more than a day. With the aim to make quite a number of pips in profit, 30 - 60 pips.

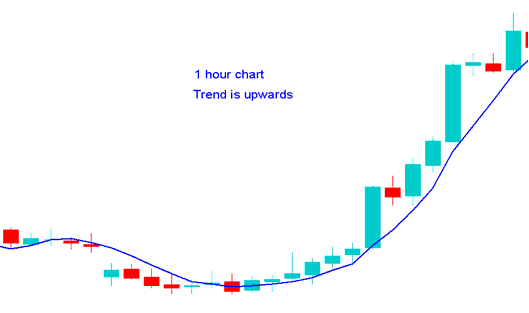

Day trader 15 minutes chart wants to open a buy trade, checks 1 hour chart, which resembles the chart below, since 1 hour chart shows trend is heading up, then decides from this multiple time-frame strategy its okay to open a buy trade.

Multiple Time-Frame Analysis Day Trading - Multiple Time-frame Analysis - Forex Multiple Timeframe Trading Strategy

Swing Traders - Trading 2 or 3 Timeframes on Charts

Swing traders hold onto their open trades for few days to a week. With the aim to make a big number of pips in profit, 100 - 250 pips.

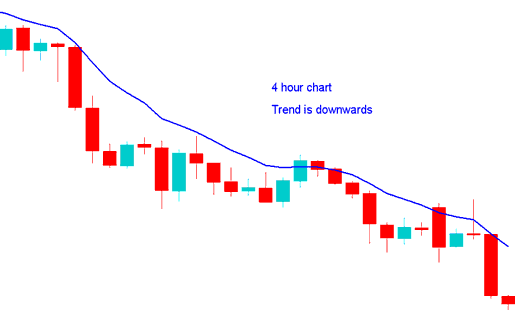

Swing trader using 1 hour chart wants to open a sell trade, checks 4 hour chart, which resembles the chart example below, since 4 hour chart shows the trend is moving down-wards, then decides from this multiple time-frame strategy its okay to open a sell trade.

Trading 2 or 3 Time Frames on Charts - Trading 2 or 3 Timeframes on Charts - Forex Multiple Timeframe Trading Strategy

Position Traders - Multiple Timeframe Strategy

Position traders are traders who hold onto their trades for weeks or months. With the aim to make a big number of pips in profit, 300 - 800 pips.

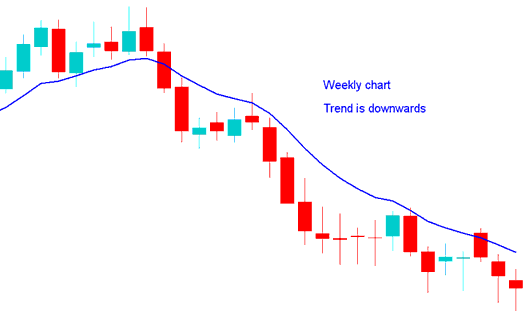

Position trader using the daily chart wants to open a sell trade, checks week trading chart, weekly looks like the chart example below, since weekly chart shows the market trend is moving down-wards, then decides from this multiple time-frame strategy its okay to open a sell trade.

Multiple Time-Frame Strategy - Forex Multiple Timeframe Trading Strategy

Technical Analysis Using Multiple Timeframes - Trading 2 or 3 Timeframes on Charts