Divergence Trade Setups - RSI Indicator

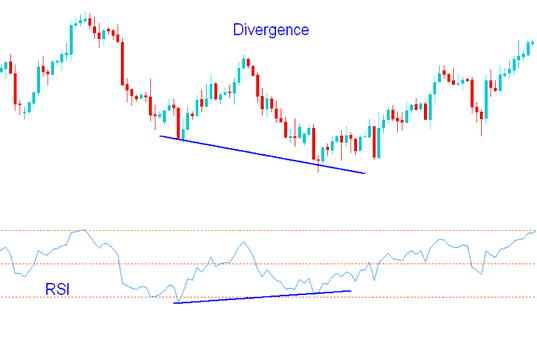

Divergence is one of the trade transaction patterns used by the traders. Divergence trade setup involves looking at a chart & one more trading indicator. For our example we shall use RSI indicator.

To spot this divergence trade setup find 2 chart points at which price makes and forms a new swing high or a new swing low but the RSI does not, indicating a divergence between price & momentum.

Example:

In the chart below we spot two chart points, point A and point B (swing highs)

Then using RSI we check and analyze highs made and formed by the indicator, these are highs that are directly below Chart points A and B.

We then draw one line on the chart & another line on the RSI technical indicator.

RSI Divergence Trade Setup

How to spot divergence setup

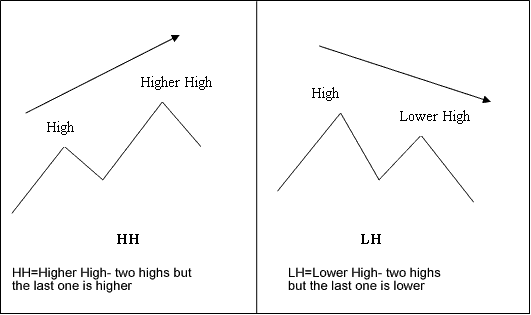

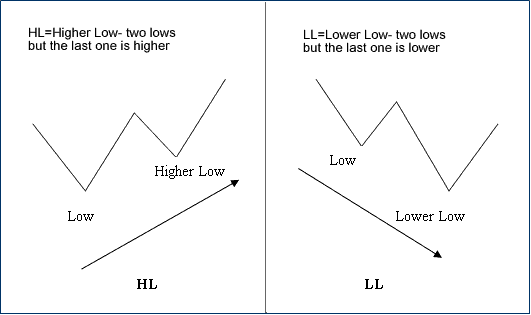

In order to spot this setup we look for the following:

HH = Higher High - two highs but the last is higher

LH = Lower High : 2 highs but the last is lower

HL = Higher Low : 2 lows but last one is higher

LL = Lower Low : two lows but the last is lower

First let us look at the explanations of these trading terms

Divergence Trade Terms

Divergence Trade Terms

There are 2 types of divergence trade strategies:

- Classic divergence trade setup

- Hidden divergence trade setup

Get More Lessons:

- Placing Channels on XAUUSD Charts on MT4 Gold Charts

- What are Linear Regression Buy and Sell Signals?

- How Can I Trade MetaTrader 5 XAU USD Trendlines and MT5 XAU USD Channels on MT5 XAU USD Charts?

- How Can I Use Fractals Trading Indicator in Trading?

- How Much is 0.01 Lot in Trading?

- Chandes Trendscore MetaTrader 5 Analysis

- EUR AUD Trading Spreads

- EURSGD System EURSGD Trading Strategy

- How to Set GER 30 on MT4 PC

- List of Gold Review Broker Review