EURJPY News Strategies - Example of EURJPY News Trading

Economic news releases for EURJPY often evoke strong moves in the EURJPY currency pair, creating a lot of short-term EURJPY Forex opportunities for EURJPY breakout traders.

However, not all economic reports for EURJPY are tradable. Some of the economic news have a significant effect on the EURJPY currency pair while others do not have any effect on EURJPY currency pair. By looking at the economic calendar traders can find out the significance of the upcoming reports for EURJPY, and find out whether the economic report is worth trading or not when analyzing EURJPY currency pair.

The EURJPY FX news reports are marked in terms of significance. There are three levels of significance: RED, ORANGE, GREEN. The most significant news reports for EURJPY are marked in red: the least significant for EURJPY are marked in green, while those marked in orange are in between.

EURJPY News Trading Strategies:

Trading the EURJPY breakout channel - EURJPY News Trading Forex Strategies

Traders simply set Buy & Sell limit orders on both sides of EURJPY price channel, so when the EURJPY news data comes out one of the EURJPY orders will probably be hit. Although this method is very simple, it also carries risks of potentially hitting the two EURJPY orders: Buy & Sell EURJPY trade orders as the market is volatile because of the economic reports. In such a double-hit situation forex traders will face losses on one or sometimes even both EURJPY trades.

By analyzing the EURJPY news report - EURJPY NEWS Forex Strategies

Traders can predict most probable outcome of the EURJPY news by looking at the EURJPY economic calendar fields labeled as Forecast and Previous. These news figures are then compared with the economic data released to give an idea about the current economic situation so as to analyze how to trade the EURJPY currency pair.

Traders trading EURJPY watch the news report and pay attention to the actual numbers released. If the EURJPY numbers come as a surprise meaning the reports are not close to what was expected or forecasted, then fundamental analysts opening EURJPY positions will do so according to the economic reports - If the EURJPY news report is better than expected then fundamental traders open buy positions. If the reports are not favorable traders open Short positions.

The most important thing you have to know about EURJPY fundamental analysis is the market expectation of an economic indicator. Economic analysts provide a prediction of a probable number of the economic indicator to be announced. This has an impact to the EURJPY market and traders are positioned accordingly to trade EURJPY currency pair. When the economic indicator is announced it affects the market only when the report is different from what the market expected. That happens because every available economic indicator available to the public information is already taken into account when trading EURJPY.

Example of EURJPY News Trading

The best EURJPY news strategy, is one that is based on the economic news calendar used to time when the news releases are to happen so as to trade these EURJPY data reports. A EURJPY trader will keep a schedule of these economic new times and prepare how to trade the data before & after the data is released for the EURJPY currency pair.

A EURJPY trader can get the times of when the economic data for EURJPY currency pair are to be released by observing an economic calendar. The economic news calendar contains the time-table of when news data for EURJPY are bound to be released. The economic news calendar is compiled by Financial Analysts and Economist who study the fundamental reports & economies of the world. This News Calendar will show the timetable for all the news releases scheduled for the next 30 days for the EURJPY currency pair.

By having this economic calendar a EURJPY trader can schedule when to trade these EURJPY economic data reports well in advance. To obtain a copy of this calendar a trader can search for "Forex Calendar" and you will find a couple of these economic calendars online hosted on various sites.

An Economic Calendar will normally have three readings:

- Previous Reading

- Forecast

- Actual News

Previous Reading - This piece of the data shows the previous value or reading of a previous news reports. Most fundamental reports are in the form of numeric numbers or percentages.

Forecast - Forecast shows the value for the news that economic experts predict for that particular report. This value is forecasted way before the date of the economic release. Economic and Financial Analysts will put across their forecast.

- If the forecast number is better than previous, EURJPY traders will buy the currency associated with the good forecast

- If the forecast number is worse than previous, EURJPY traders will sell the currency associated with the bad forecast

Actual News Release

This is what will determine if there will be a large price movement or none at all.

If the actual data release is same to the forecast, then there will not be much movement, this is because EURJPY traders anticipated this data and have already traded the news even before the actual data was released.

If the actual news release isn't the same as the forecast, this will come as a surprise to the EURJPY traders, if the forecast and actual data release isn't the same then, the EURJPY traders will have to adjust their trades accordingly and this will cause a price reversal in the opposite direction of the EURJPY Currency.

If likewise the actual data reading was way better than expected, then price will continue towards its direction and gain further momentum towards that direction. Likewise, if the actual news report is worse than predicted price movement also will continue in the same direction as that of before the news release and this time gain more momentum & move further towards that direction.

Example:

When the new information is announced then it has impact on the market only if it is different than expected. If the information is as expected then it has no impact on the EURJPY currency pair because the information is already available to the public and has already been taken into account.

In order to use the forex fundamental analysis, you should first be able to know market indicators. Economic calendar containing all the fundamental indicators is created by economists. Economists also use this Economic calendar to predict different news reports. These predictions are provided by market analysts. This can have great impacts on the market when trading the EURJPY currency pair. EURJPY Traders will watch out for news announcements that have a great impact on the financial markets.

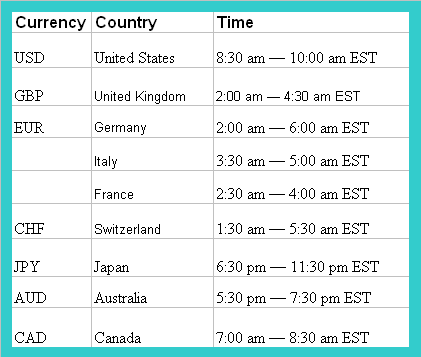

When are economic news released? - EURJPY News Strategy

EURJPY Economic Reports Announcement Times of the major economies and major currency pairs traded in the forex market.