Engulfing Candlestick Strategy - Engulfing Candle Rules and Types of Engulfing Candle Setups

Bearish Engulfing Candles Pattern in an Uptrend - Bullish Engulfing Candles Pattern in a Downtrend

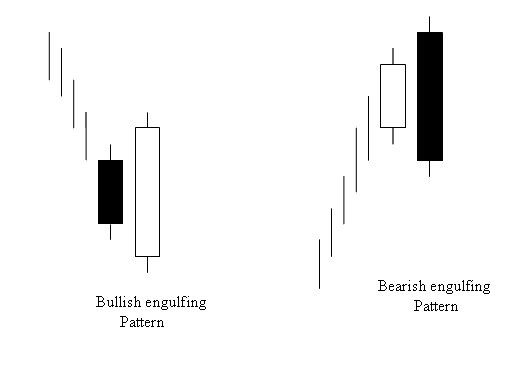

Engulfing Candles Pattern is a reversal candles pattern which can be bearish or bullish depending upon whether it appears at the end of a downward trend or at the end of a upward trend.

Bullish Engulfing Candles Pattern - Bearish Engulfing Candles Pattern

Bearish Engulfing Candlestick in an Uptrend - Bullish Engulfing Candlestick in a Downtrend

Color of the first candle indicates the trend of day.

The second candle should completely engulf the first candle & it should have opposite color.

For Bullish Engulfing color of candles should be Blue

For Bearish Engulfing color of candles should be Red

Engulfing Candle Strategy - Bearish Engulfing Candles Pattern in an Uptrend - Bullish Engulfing Candles Pattern in a Downtrend

Morning Star Candle Setup - Evening Star Candlesticks Pattern - Engulfing Candle Setup

Morning Star Candle

Morning Star Candle

Forex Analysis of Morning Star Pattern

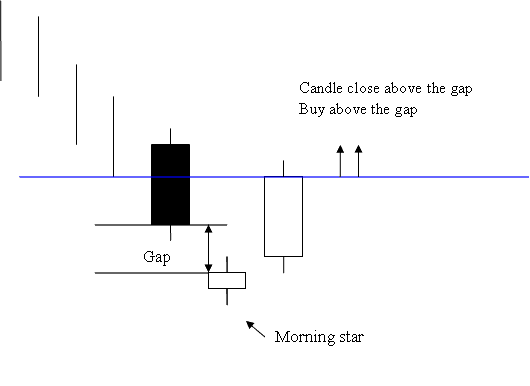

Morning star candle-stick setup is a three day bullish reversal candlesticks pattern.

First day is a long black candlestick.

Second day is a morning star that gaps away from the long black candlestick.

Third day is a long white candlesticks which fills the gap.

The filling of the gap & closing of the white candlesticks above the gap is a strong bullish signal.

Forex traders should open a buy trade after market price closes above the gap formation of the morning star. This is confirmation signal of a buy signal generated by this candles pattern.

Evening Star Candle

Opposite of the morning star

Evening Star Candle

Forex Technical Analysis of Evening Star Candle Pattern

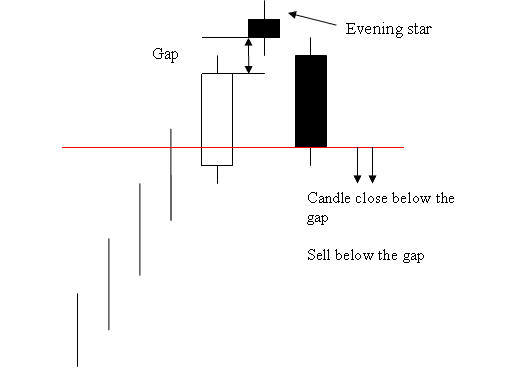

Evening star candle-stick setup is a three day bearish reversal candlesticks pattern.

First day is a long white candlestick.

The second day is evening star that gaps away from the long white candlesticks.

Third day is a long black candlesticks which fills the gap.

The filling of the gap and closing of the black candlesticks below the gap is a strong bearish signal.

Traders should open a sell trade transaction once the market closes below gap formation of evening star. This is confirmation signal of a sell signal generated by this candles pattern.